What if I tell you that the different property stages may impact your investment decisions, would you believe me?

How would you approach it if you knew there was more to just buying a property because it’s time?

Read till the end as there are not 1, not 2 but 3 main stages in a property cycle you must know in order not to make mistakes in your property journey

Let me tell you a true-to-life story. Nicole wanted to invest in real estate, knowing that properties are the most stable investments that would surely pay off in the long run. So, she did all she could to save up and get more income streams to purchase her first property.

She felt so accomplished to have bought a $1.2 million resale property at only 26 years old, and it wasn’t just any low-rate property. It had all the credentials to become a success: it’s in a prime location that’s only a three-minute walk from the MRT. It was situated on a high floor with unblocked views.

The unit was so special for her (aside from the accomplishment for a person her age) because she bought it at such a steal price. She got it from the owner after four years of use at the cost of a lower floor unit, which was really at the seller’s loss.

It was a sure hit! Or so she thought. A few years later, she started her own family and needed more space. Naturally, her unit was too small for them to breathe.

Unfortunately, it was at the same time that the government introduced cooling measures, which locked her property at a low rate. She couldn’t sell her unit as high as she had hoped because:

She had to make an abrupt decision to sell. The time wasn’t ripe to “harvest,” so to speak.

She actually didn’t have the best property. It looked like a handsome deal when she was younger, but there were better ones that could offer a maximized return.

She missed opportunities. Throughout her course of payments and as she settled on her current investment, she wasn’t able to put her money on the right property.

Believe me, I’m as heartbroken as she is.Can you imagine setting yourself to this expectation for as long as you could remember, only to find out that it wasn’t a good investment in the end.

Do you also have some experience or heard from someone before in a similar situation?

How can we avoid that, then? This is where I would like to step in with my expertise. In my years in the business, I have seen the rise and fall of property investments and can guide you how to safely earn 6-figure profit through the use of data and analysis.

Here are the points I want to share with you:

Past generations will buy their property and keep it beyond 15, 20 or even 30 years and still make comfortable profits over time.

Anyone will be able to do that and still profit from it, right?

Let me share with you this 1 secret:

Calculate the amount of profits you have made and divide by the number of years you are holding that property. How does the % look like now?

Anyone and everyone is able to Buy a property and hold it for profit.

But how can you gain the highest growth potential in the shortest period of time?

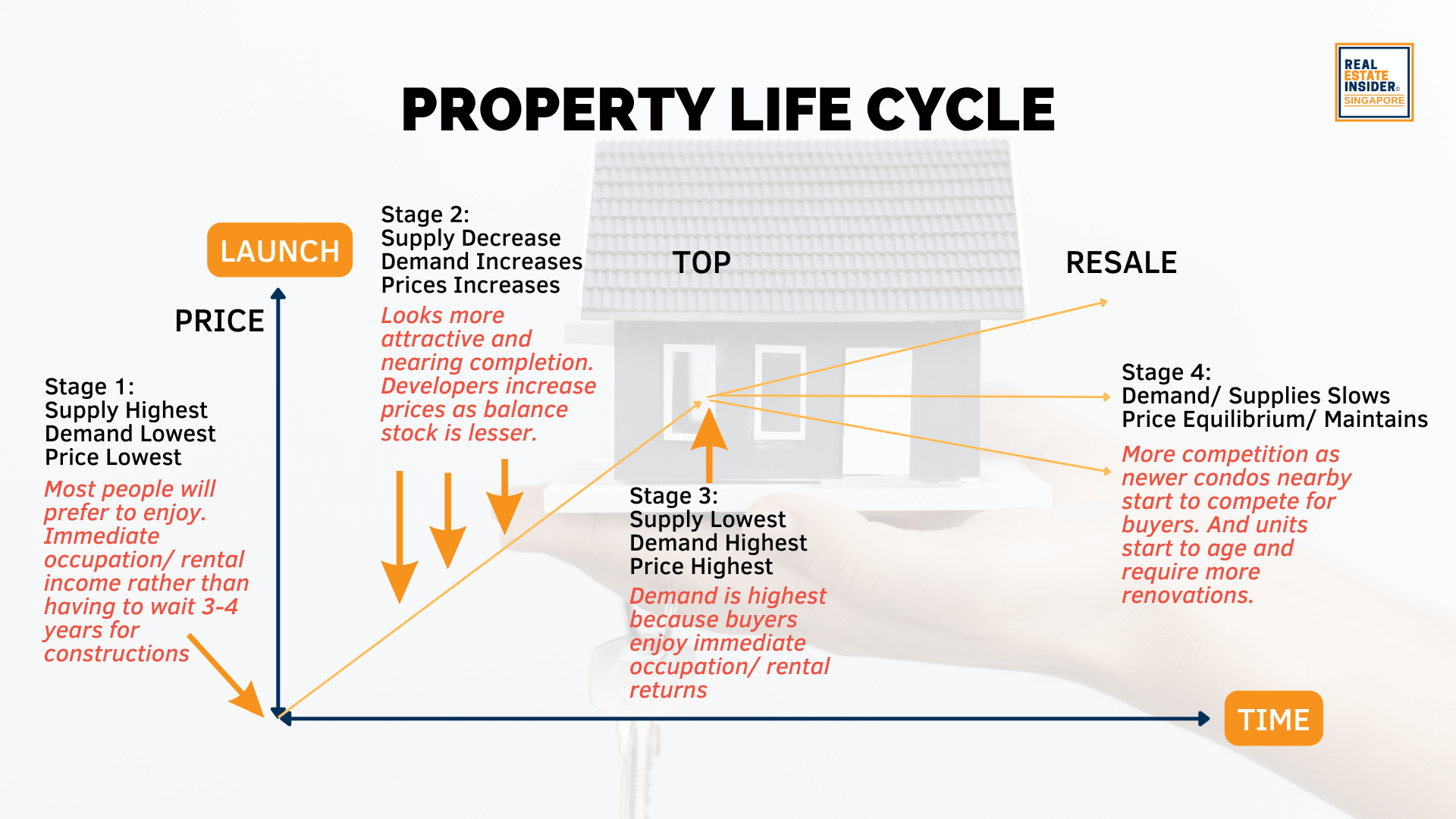

This requires a strategy by understanding this: The property life cycle.

This is what we guide all our clients and families in achieving: the highest growth potential in the shortest time. Throughout the many consultations I have held with homeowners, I noticed that there is a pattern when it comes to holding periods.

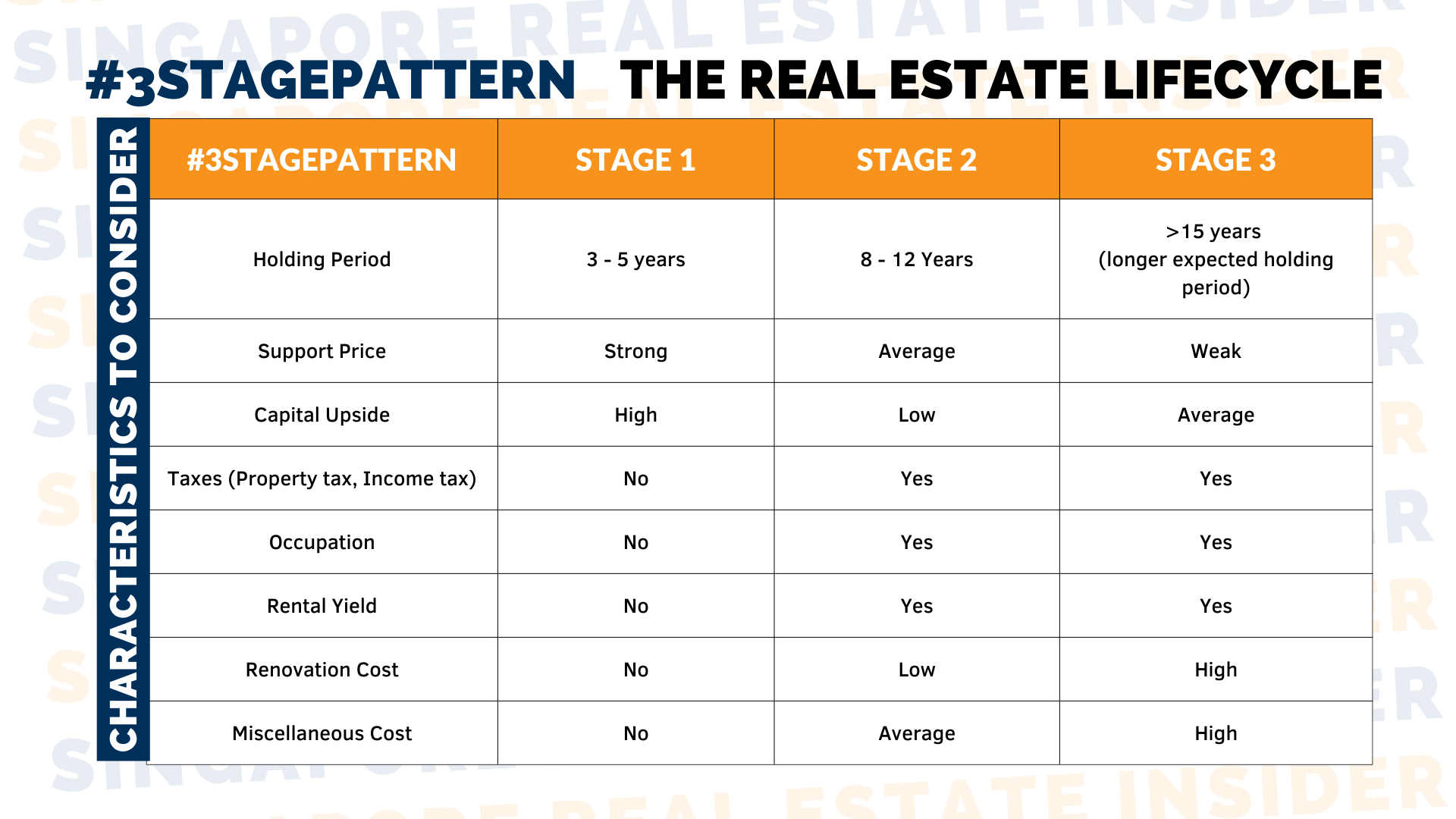

Let’s break it down into stages:

Stage 1: 3 – 5 years

Stage 2: 8 – 12 years

Stage 3: >15 years

In any investment, your goal is to enter at the right time to make the most of your real estate investment.

New sales or properties you purchase at launch would have a steady growth for the first 3-5 years. Take a look at how properties inevitably acquire a spike by 8-12 years. And it does take quite a leap. Later on, it moves toward maturity at 15 years.

Depending on your plans and objectives you set forth, following the Real Estate Life Cycle does give you an edge to know when you should enter and exit to maximize your property potential.

Now, rewind back and take a screenshot of it now.

Rewind + repeat a couple of time

Example:

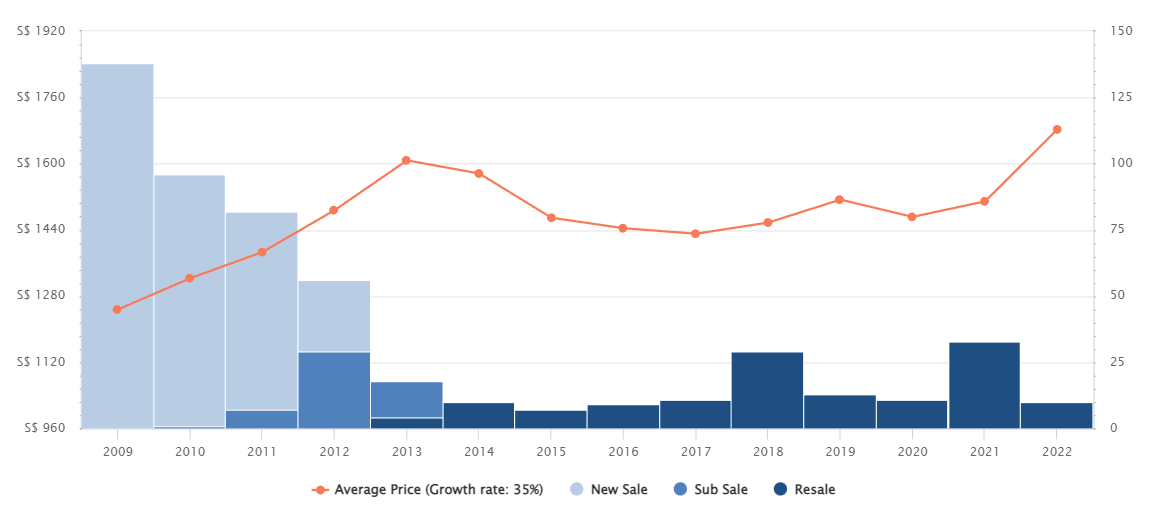

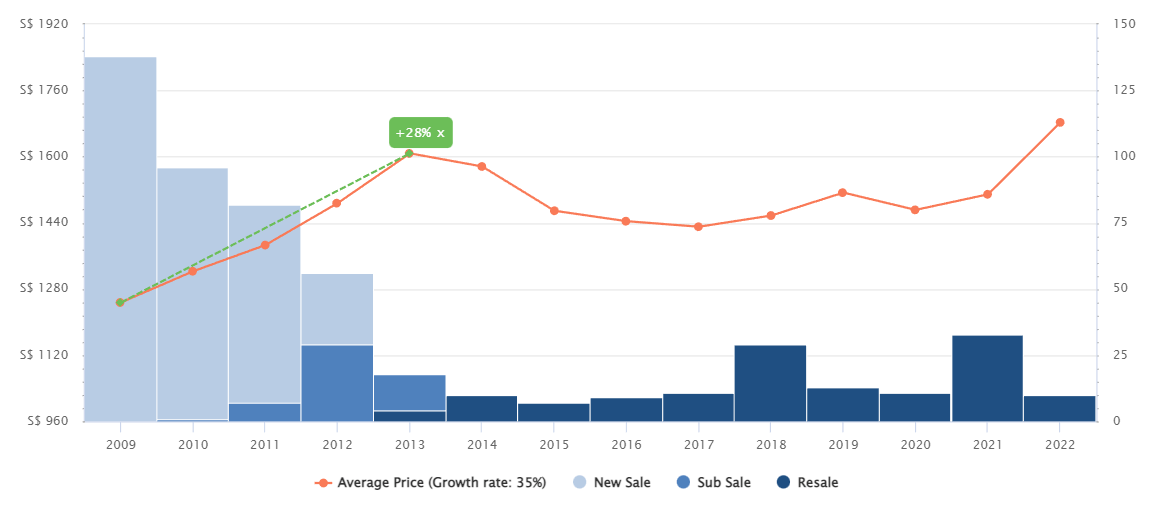

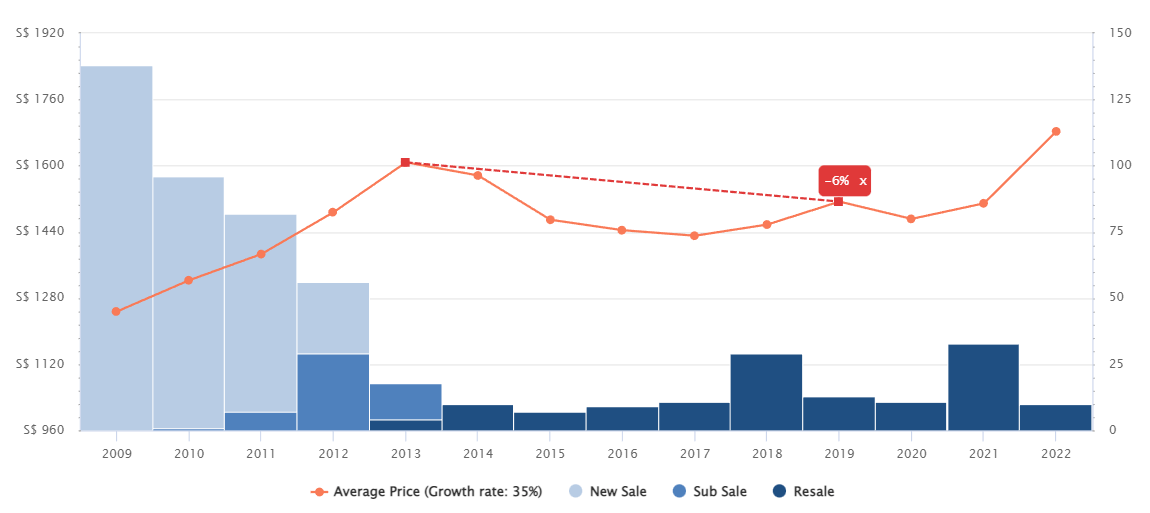

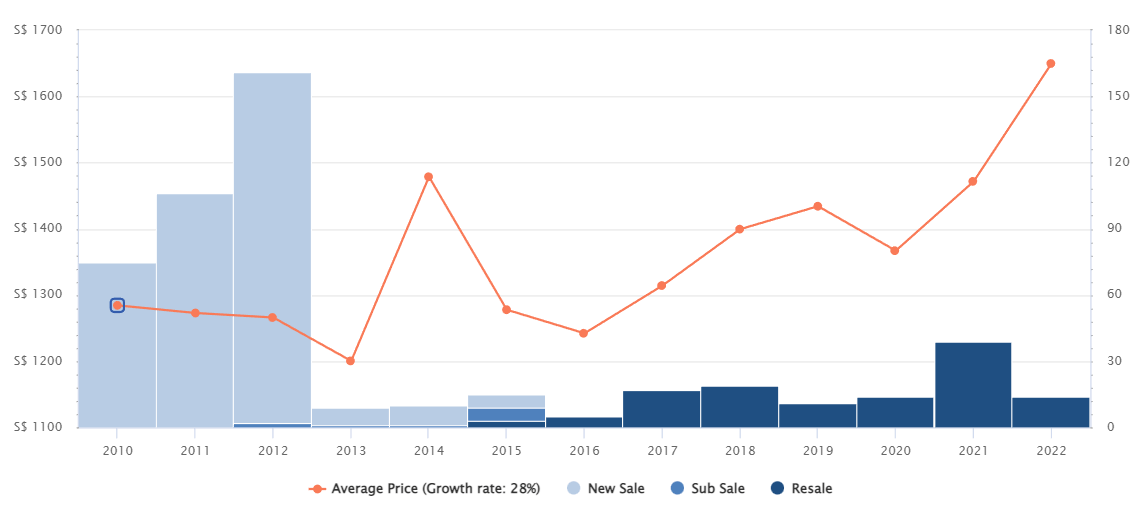

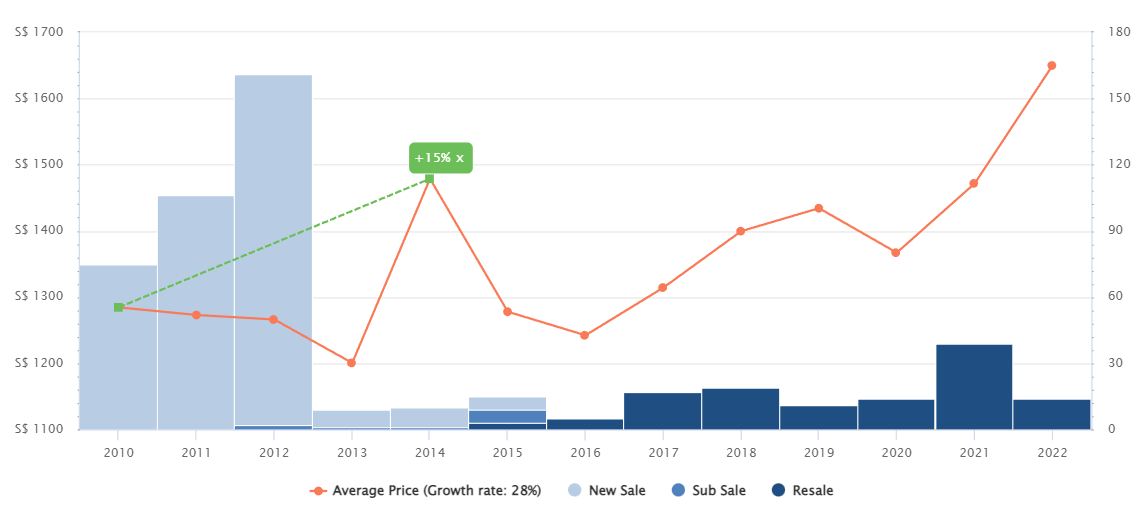

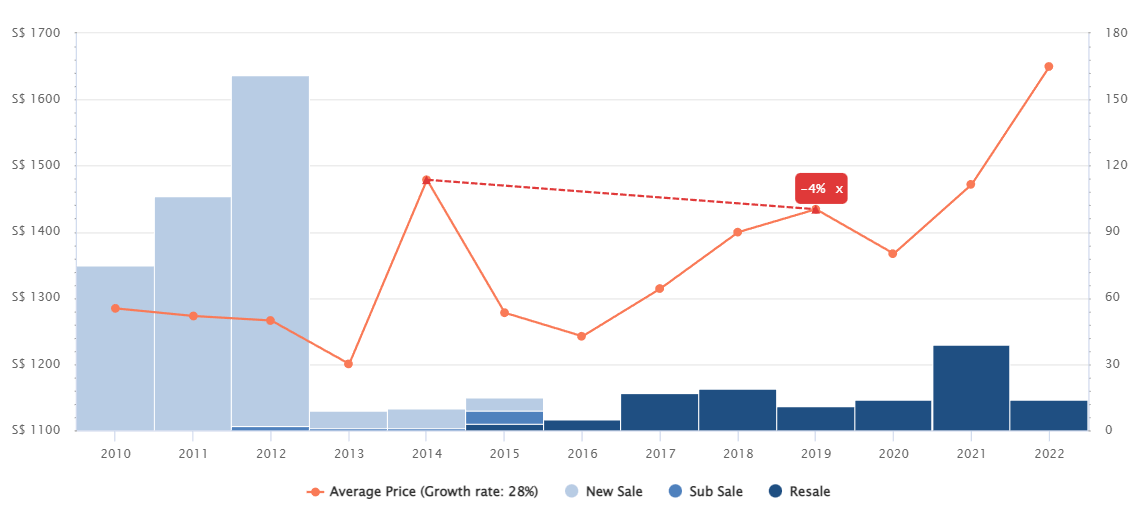

ASCENTIA SKY by Wing Tai in district 3, this development has 373 units and is at Alexandra & commonwealth area. Being a high rise of 45 storeys, the unit is standing hall among the others in the same estate.

Lets take a look at Stage 1 of ASCENTIA SKY. where the capital upside is high and having a very strong support price appreciating 28% from its launch to TOP.

An adjustment we can see here at Stage 2 when passes the 8 year mark seeing the value drop by around 6%. Can you imagine if you enter this property at this stage regardless of which year it is, you will be holding onto the property as it is not making much profits. Because age is a factor and at stage 2, its capital upside is very low.

So do take note of this when you buy your property next and be aware which cycle you are buying in.

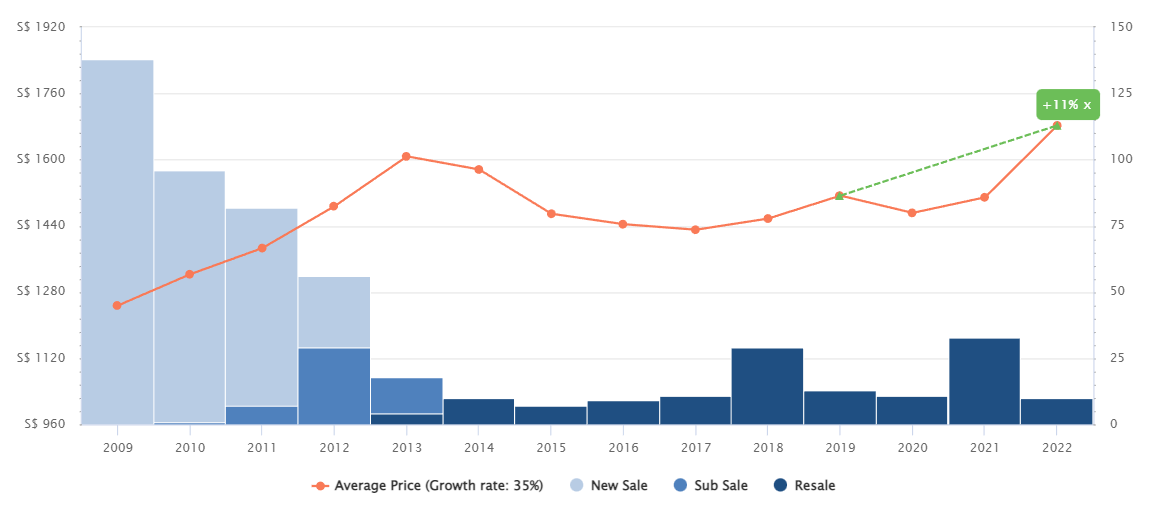

At Stage 3 when the capital upside is average, we can see it rebound back citing the robust turn of events after 2020 Covid and huge demand for properties continue to surge. Increasing the overall value to 11%.

Do always note that if you decide to enter a property beyond stage 3 due to whatever reason, be prepared to hold the property much longer awaiting the next cycle increase.

Now, in real estate, there are a few rules that need not be said. First, never sell below the cost. Why would anyone do that?

Second, the goal is to earn profit.

If you’re wondering why some people would buy a property during the first five years, we have observed that these are usually grabbed by families, newly-married couples, and individuals who need to move in right away. You can sell during this stage with a usually premature income.

But as the property moves to stage 2, where TOP is happening. More people tend to buy during this stage, and you can walk away with $300,000 profit and above.

Example

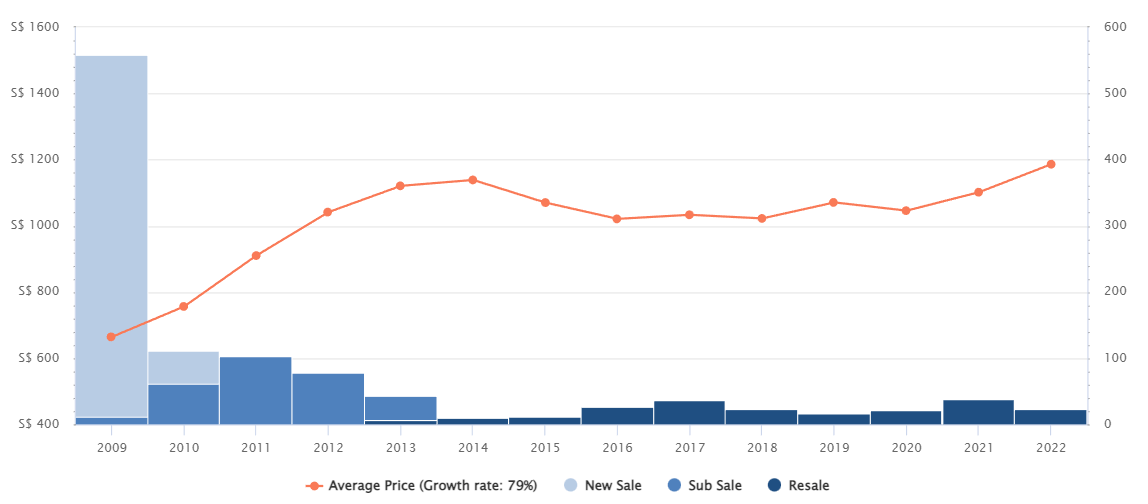

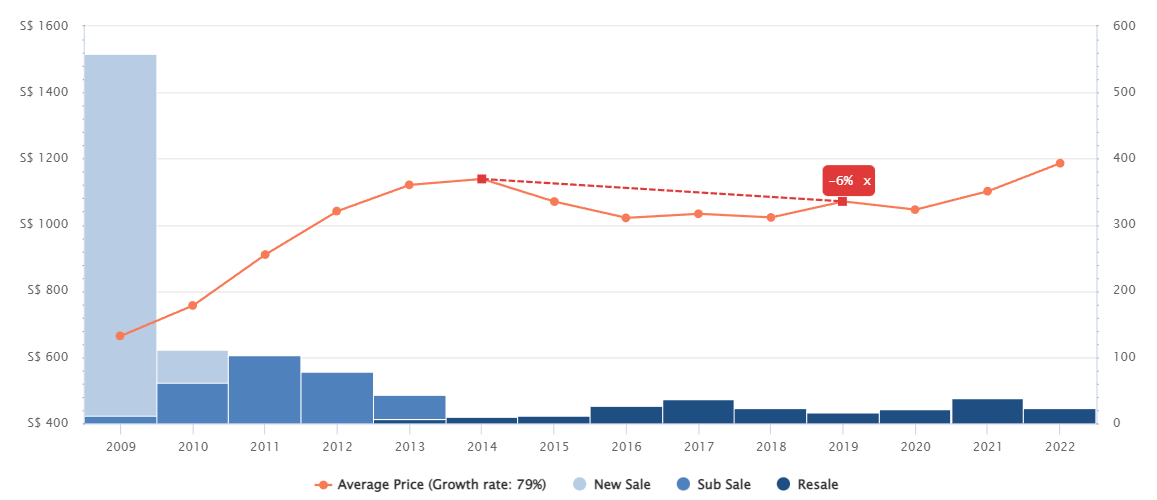

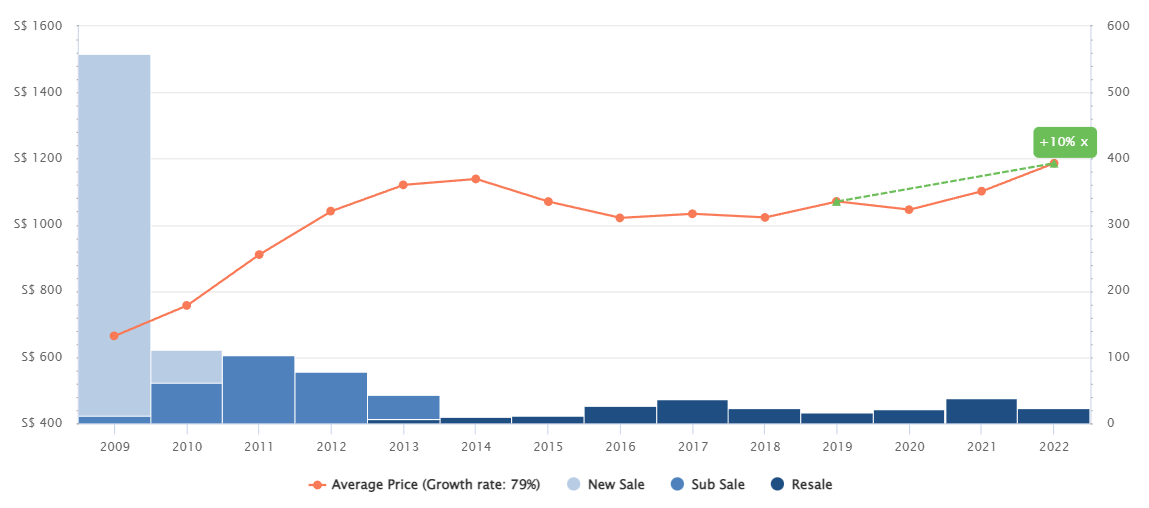

Double Bay Residences, a 99-leasehold property at Simei. It has 646 units.

At its stage 1, the property value climbed 71%. Can you imagine if you had purchased a 1000sqft unit, in just under 5 years, you potentially would have pocket $710k just like that. Ka Ching!

how many years would we have to work hard and save that amount? Very very long time.

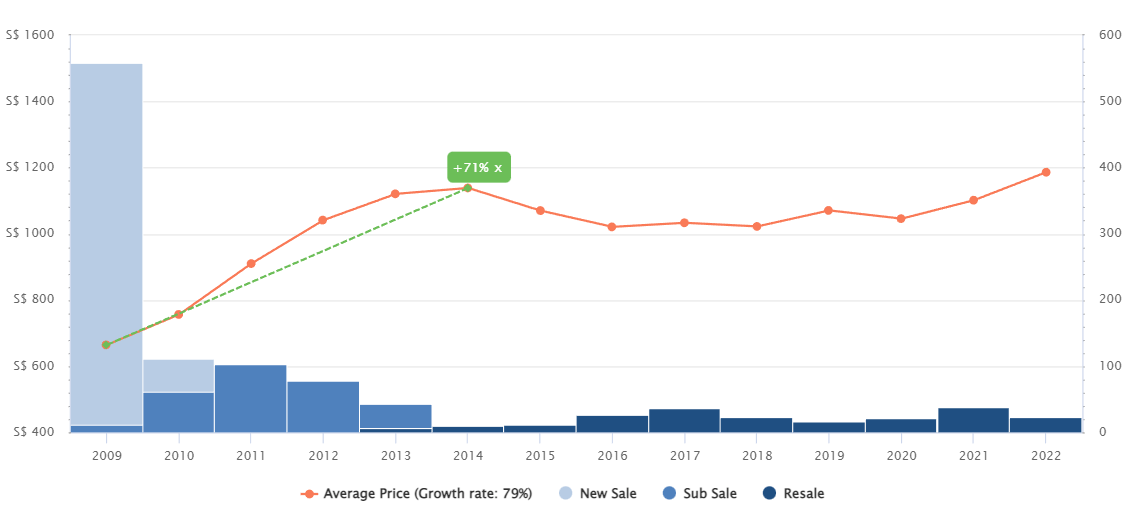

But as we can project the future outcome after thousands of properties research, the next cycle will see a drop of 6%.

Although stage 3 already started showing an increase of 10%. Can you imagine if without the 2021 and 2022 upswing market trend that pushes the prices up across the entire Singapore, this property likely might still be growing very slowly or even stagnant in price.

This is also the reason why many homeowners are riding on the high price trends now to swap their property out to a better location or bigger unit size.

Another way to look at the Property Life Cycle is through these stages:

Stage 1: It’s where the supply is at the highest, but the demand is low because most people prefer to settle in the units immediately rather than wait for 3 – 4 years for the construction completion of new ones; therefore the price is at its lowest as well.

Stage 2: Looks more attractive for home buyers and property construction is near its completion. Supplies decrease while price increases along with the demand.

Stage 3: Here, demand is highest because buyers enjoy immediate occupation or rental returns, causing low supply with high asking prices.

Stage 4: As time passes, more competition develops, and maintenance costs are now creeping into older properties, causing the supply and demand price equilibrium to slow down.

What about freehold property. We might also have the perception because we are holding on to a freehold property, its performance and growth should outweigh a leasehold?

Lets explore further.

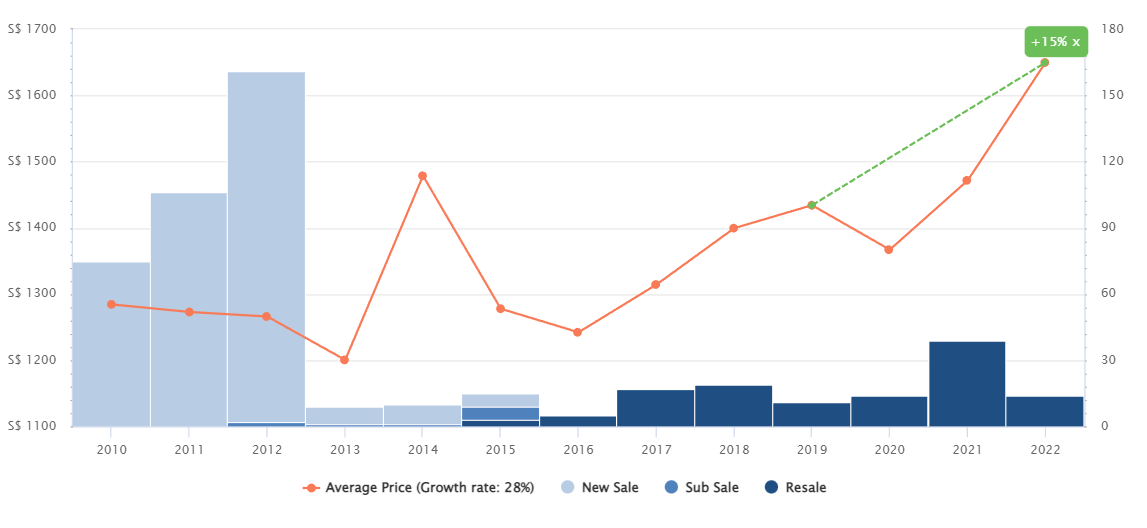

If you are an easterner, you would know this property, Flamingo Valley. A Freehold property in east coast, siglap with 393 units in total.

Let’s take a look at its performance when they are 1st launched. A growth of 15% in stage 1 where the capital upside is the greatest.

Surprise seeing this? Its similar outcome as compared to a 99 leasehold where this freehold property at stage 2 is losing about 4% in its value.

And eventually, as the market moves up together across all property types in 2021 and 2022, the climb for flamingo valley reaches 15% very quickly.

So you can see, besides the property stages to take notice of, there are also other factors to consider. A disclaimer here. In general, we are seeing such trends in many properties we have research on and there are some that go against this trend as well. But they are rare.

How are your property investments looking right now? I hope it’s promising. If you need a hand in making the right decisions, contact me, and let’s schedule a consultation to achieve your property investment goals!

Click here for a complimentary call with us.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.