Who wouldn’t be dismayed by the headlines about interest rate hikes rolled out one after another? If I didn’t know better, I would be discouraged to invest, too.

But not you. Why? As part of the Singapore Real Estate Insider community, we are here to back you up with sound advice on making the most of your investments.

And I will show you how you can save money instead of spending more even with the rising interest rates. So read till the end as I share with you in detail.

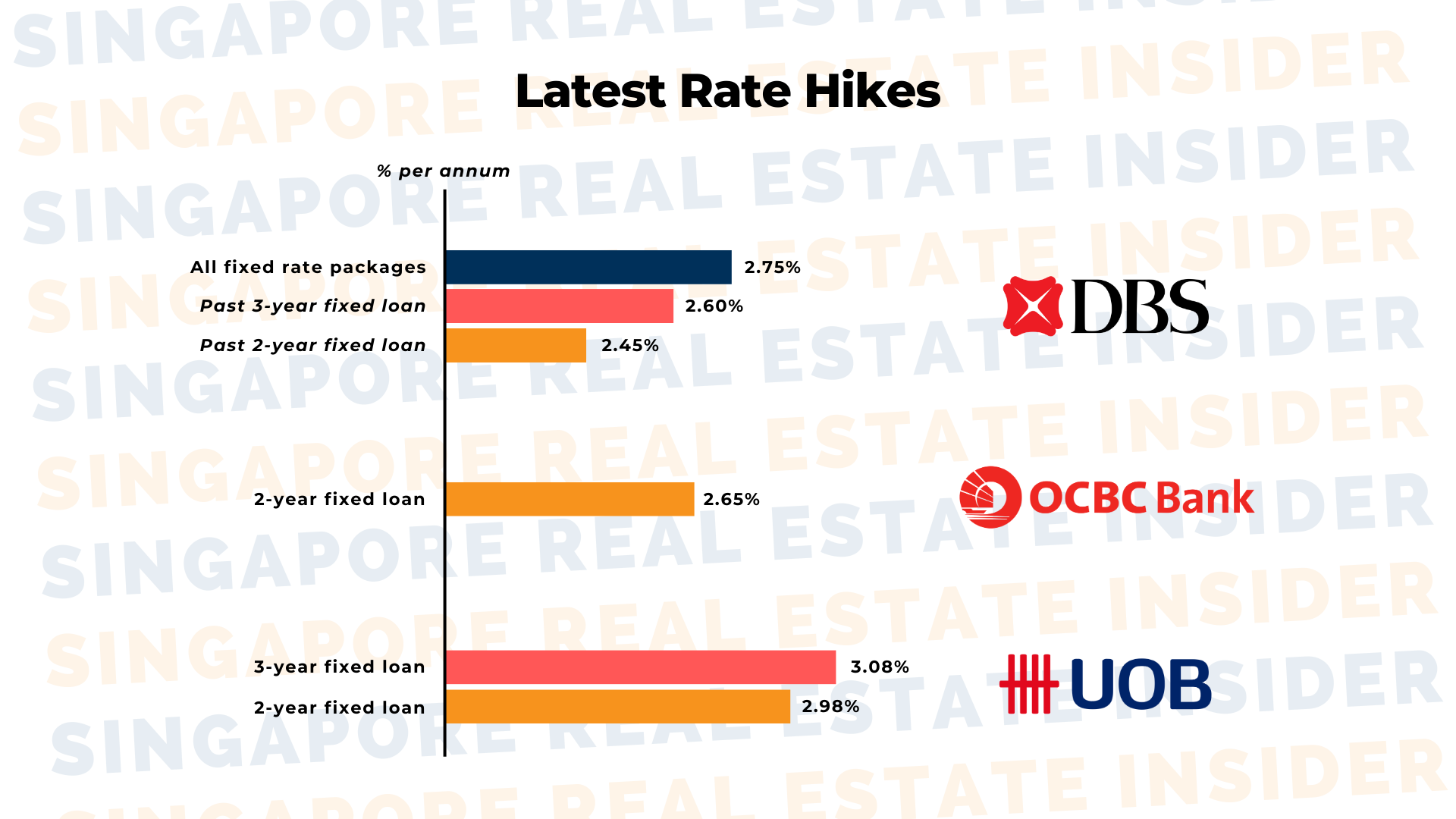

First, let’s catch you on with the latest on rate hikes. In the last couple of months, there has been a scramble for home buyers to lock in the current interest rates before it climbs up again.

Some banks have already imposed higher than 3% interest rates soon as the inflation started, and more than that, they hit the pause button on fixed-rate loans. Because of this move, most homeowners are taking the stakes with floating home loan rates to get better deals for their money.

Floating loan rates are at the mercy of the compounded Singapore Overnight Rate Average, also known as SORA. This three-month rate affects floating loan rates to climb from 2.1 to 2.3%. at 1.3% as we speak; as much as I hate to break it to you, that’s the highest recorded rate in the past decade.

So how do these numbers affect homeowners? Believe it or not, it might not have as much of the dreaded impact for buyers. Let me illustrate.

Ms. Woo bought a $2M property with a 2.4% interest rate, a loan tenure of 30 years, and finally, a 75% loan value. Her monthly dues come out to $5,888.

But her bank implemented a higher interest at 3.2%. With the same credentials, her monthly dues come up to $6,487 per month.

That’s about a $599 difference, which is about $21,000 when accumulated in 3 years.

Please note that I mentioned three years because homeowners can start selling by this time since their SSD would be done.

So, returning to my point: the hike wouldn’t be too much of a bother.

Why?

First, if you compare these numbers against the rising housing prices and profitability, the interest is minimal compared to the increase in value your property can incur.

These interest hikes will be rolled out in small implements. Thank goodness!

Can you imagine taking all of them in one blow? There will be a progressive scheme for private properties. Second, loans are usually lower in the first repayment schedule.

Homeowners might end up with manageable increases of around $100 a month, much less felt when paid by a 2-income household or those renting out the property to cover the payments.

We do not belittle this seemingly slight increase in interest rates. After all, if a single person has been enjoying the 1% rate previously, the swift move to almost 3% can be hefty depending on the full amount of loan and the buyer’s earning capacity. It could be a headache when he is hit by unemployment or his salary is unstable.

But calm down!

OrangeTee & Tie’s Christine Sun mentioned that the “Property market may withstand the interest rate impact better than those in many other countries. Speculative activities are low, and many safeguards are in place to ensure most borrowers are not overleveraged.”

More than that, I want to encourage you with this thought: everything is temporary. Yes, even this inflation will not stay for good. Let’s hope that it will be managed globally soon. And more importantly, I urge you to continue to invest today.

The good news is that the Singapore Real Estate Insider is here to help you win in any situation. With our tried and tested The REI method, you can legally and safely pay a lower mortgage even with raising interest rate for your property.

With The REI method, you can legally and safely pay a lower mortgage even with raising interest rate for your property.

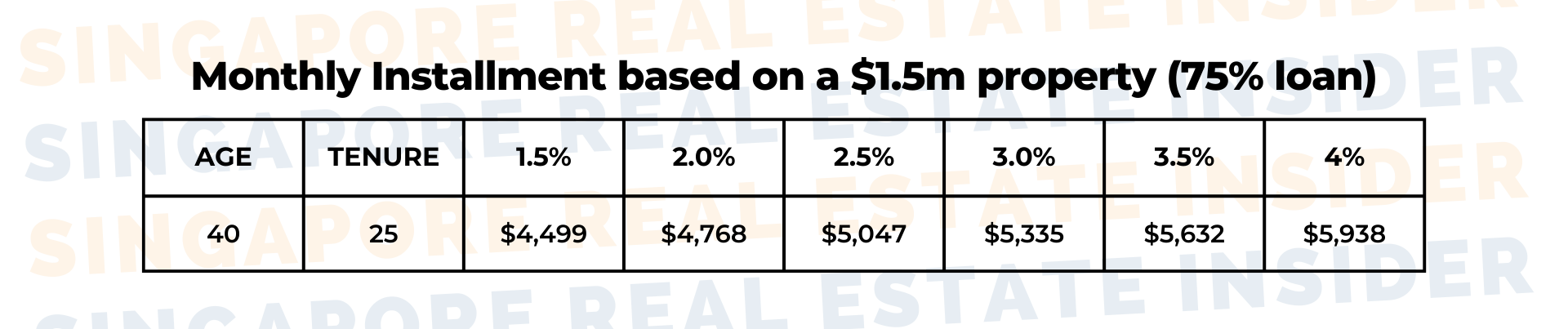

Take a look at this scenario: A friend of ours wanted to upgrade from his HDB to a private property. He’s a 40-year-old looking to take out a $1.5M property loan. With his age, he’ll be granted a 25-year tenure.

At 1.5%, his interest comes to $4,499. Notice that it had a small increase to $4,768 when the rate increased to 2%. Now, look at the jump when the interest rate climbed up to 4%, making the monthly installment amount $5,938.

He was so worried about this, so he reached out to us at Singapore Real Estate Insider.

Before diving into a significant investment such as private property, we all need to do a realistic evaluation of our capability to pay for them and study how we can earn a good profit.

I can imagine his doubts when I told him that he could actually save money and earn from his investment even if the interest rates increased.

We showed him a restructuring plan which allows him to only top up $281 on his monthly installment instead of $1,213 even if the interest rates increase.

How would you like that?

If you understand financial restructuring, you can save so much and maximize your profit when you know how to play the game through The REI method.

Another example.

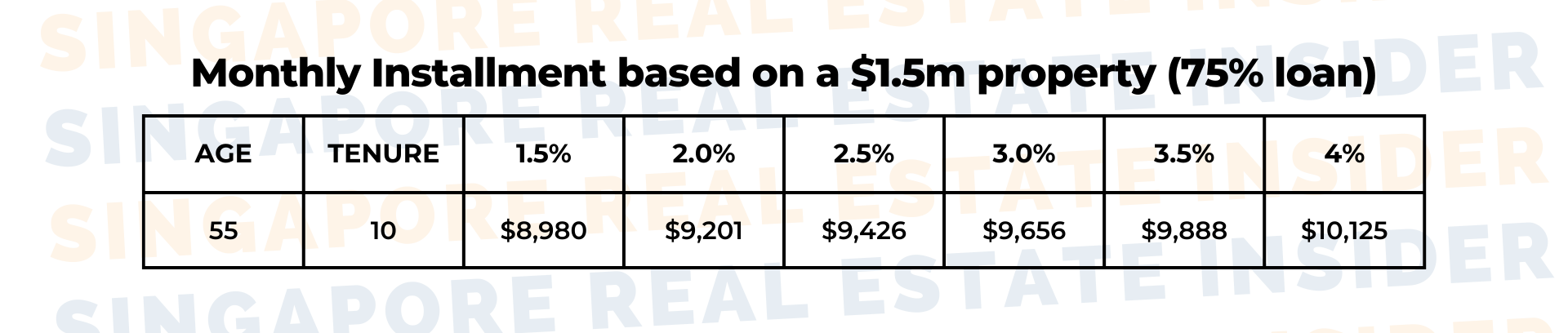

We have an older client at 55 years old who applied for a $1.5M property purchase loan. The tenure is set to 10 years, with a monthly installment of $9,201 at a 2% interest rate. If the rate increases to 4%, the monthly amount would be $10,125.

I don’t know about you, but when he came to look at the figures, the $9,201 monthly payments can be stressful, mainly because he’s semi-retired. Besides, I wouldn’t want to spend my golden years concerning myself with payments and such.

The problem is that he decided to downsize, so he needed to complete the purchase of his new property.

We sat down and reviewed his finances and shared The REI method. After careful planning, the worst-case scenario of rates rocketing to 4% (making the premium $10,125 monthly originally), we are able to help him pay only $6,209 per month instead.

That is $3,856 in savings!

It’s even lesser than the amount when the interest rates are at 2% in the beginning.

What can we learn from here?

I’ll tell you: do not fall into the big trap.

All this noise can cloud your judgment, but you can make a wise financial decision through sound methods like The REI and still make good investments for your future today.

No matter your situation, keep doing the same financial discipline that stood the test of time.

My role is to inform you that there are legal and safe ways to save money, even with high-interest rates. In my years in the business, I have seen the trends and learned the best practices.

Remember, whether you invest in a property or not today:

- Property prices will continue to rise over time.

- Older property values will suffer from decay.

- Those who invest earlier will always benefit.

- Others will continue to invest in properties even if you don’t.

How many of you wish you could return in time and buy more properties? We all want to make more. If this is you, and you want to see a successful, prosperous future for you, reach out to us, and we’ll teach you the safe and proven The REI method.

Click here for a complimentary call with us.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.