I can clearly remember my heart racing when I purchased my first property. It was as if my heart was trying to get out of my chest! And if you feel nervous about such an important purchase as a condo unit or a house, let me say this, it's normal.

Numbers do not lie here.

The fact of the matter is, purchasing a private property is a life-changing experience. It's a huge investment starting at a million dollars. So, the fear buyers could feel is valid and must be acknowledged. Disregarding it could only make it worse.

Let me lead you to make the right decisions, such as checking your finances and capabilities in fulfilling your commitments.

That means having enough financial security to maintain your lifestyle while paying your property's downpayment and monthly payables.

More often than not, you'll realize that owning your first private property is possible.

What's Next for HDB/EC Owners?

Let's say you're a married couple with a HDB/EC unit, and you're toying around with the idea of selling it and re-invest the money into buying two new properties. What is the risk, and how can it possibly turn out?

Well, the first thing we need to consider is your current finances. Consider your outstanding loans, cash on hand, and monthly spending.

Doing an honest review of your financial status will set you for success when you need to invest.

Here’s an example:

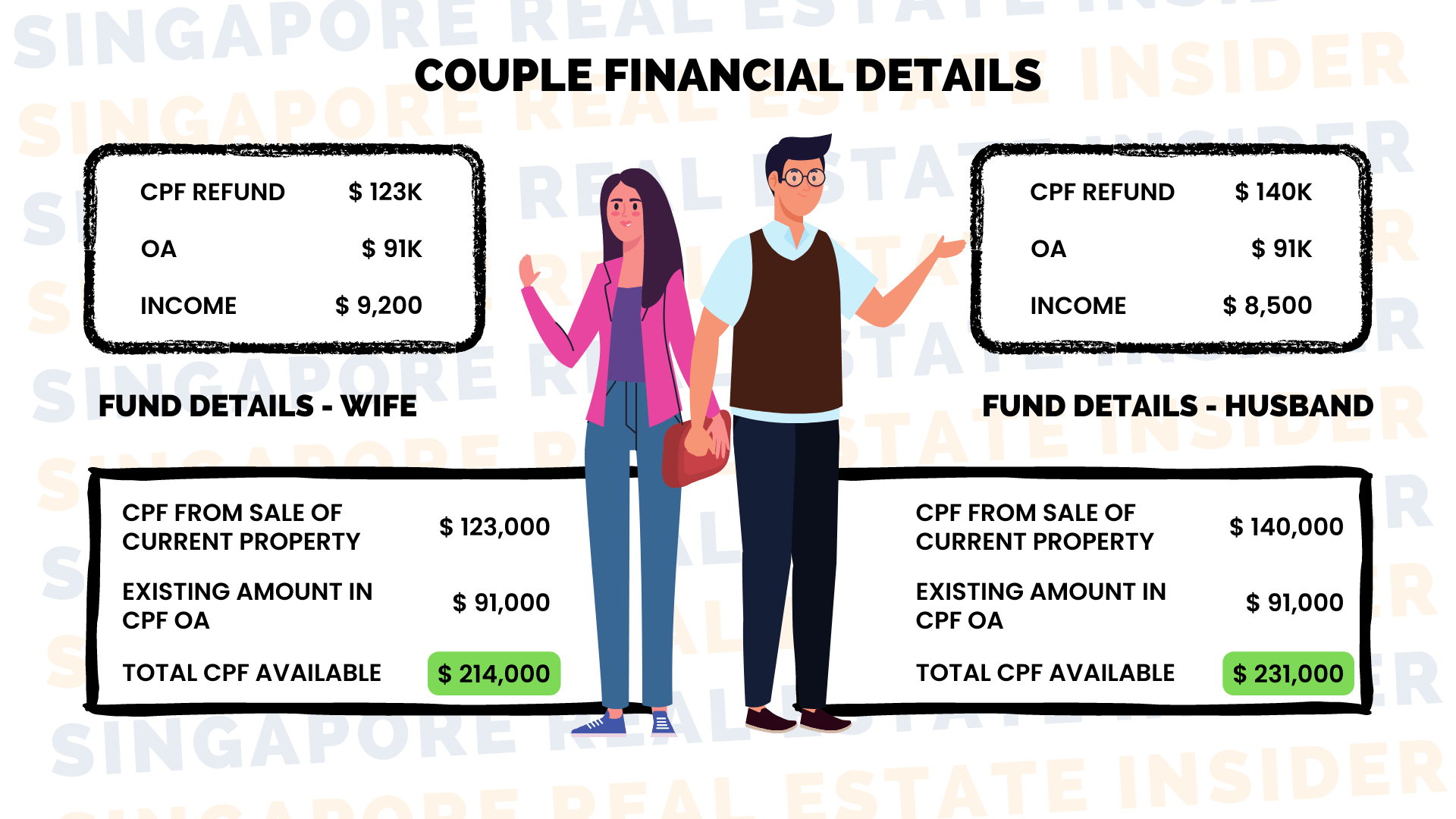

You and your spouse aged 40 & 41 owns an EC worth $1.12m with an outstanding loan amount of $509,000.

Ladies first! Let's say that you, the wife has the following details after the sale of your current property:

CPF Refund from the property: $123,000

Current OA amount: $91,000

And you have an Income $9,200

So that sums up your total CPF amount of $214,000

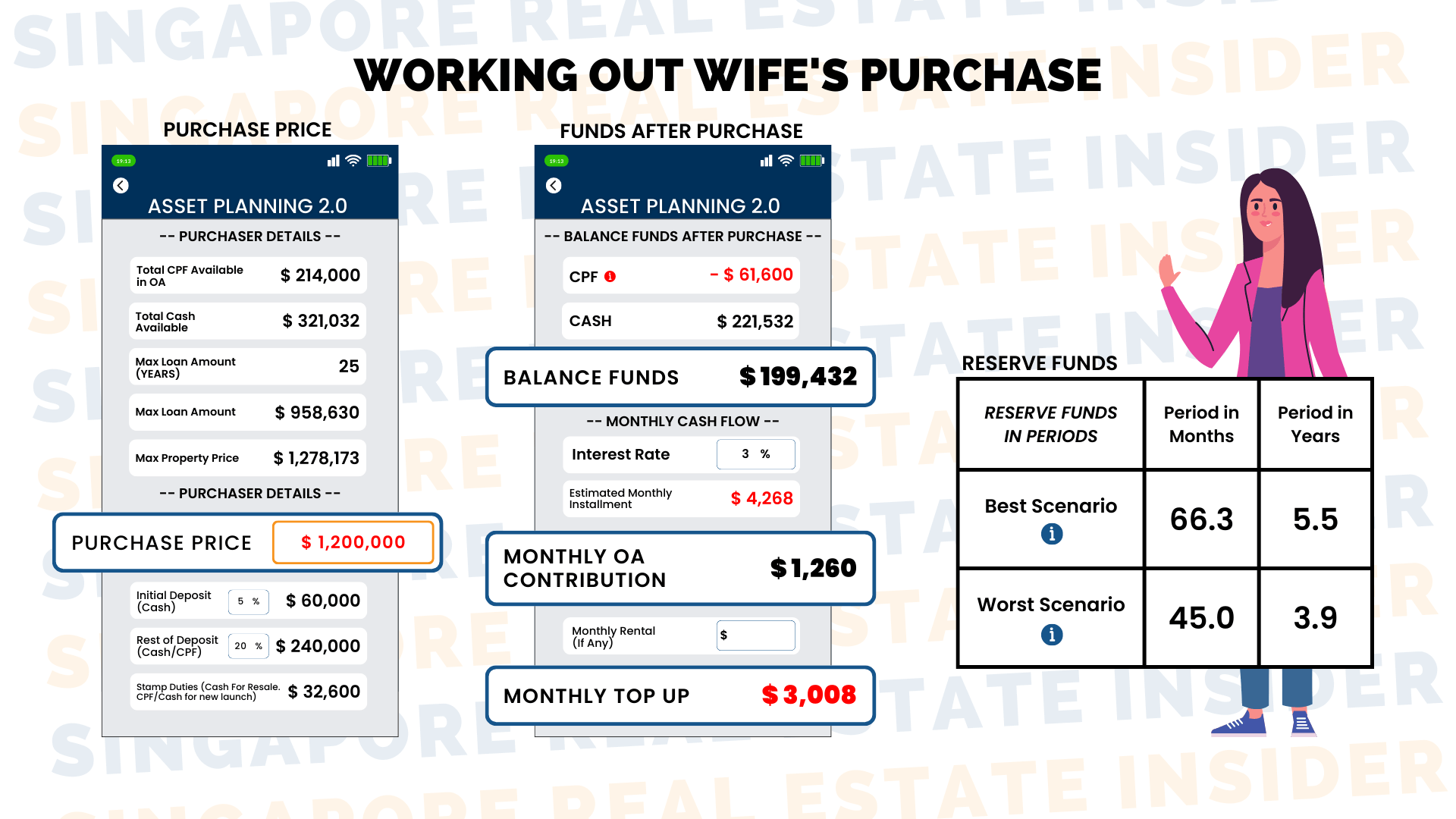

Based on the sums here, you could have a maximum loan amount of $958,630, good for 25 years and your maximum property purchase amount will come to $1,278,173.

Let's do the math that you are buying a $1,200,000 property!

Because there are enough CPF & cash in this purchase, after purchasing the $1,200,000 property, you still have a balance fund of $199,432

And her monthly cash flow goes around as such:

Estimated Interest rate: 3%

Estimated monthly installment: $4,268

Monthly top up amount is only $3,008 after deducting usage of your monthly OA of $1,260.

As for your reserve funds, the best case scenario is 66.3 months, or 5.5 years, and the worst would be 4.

Here we are having the worst scenario that you have no employment, not working with no monthly income.

Would this feel safe for you?

Now, onto the husband!

Your CPF is $140,000

OA is $91,000

With an income of $8,500

So, your total available CPF is $231,000

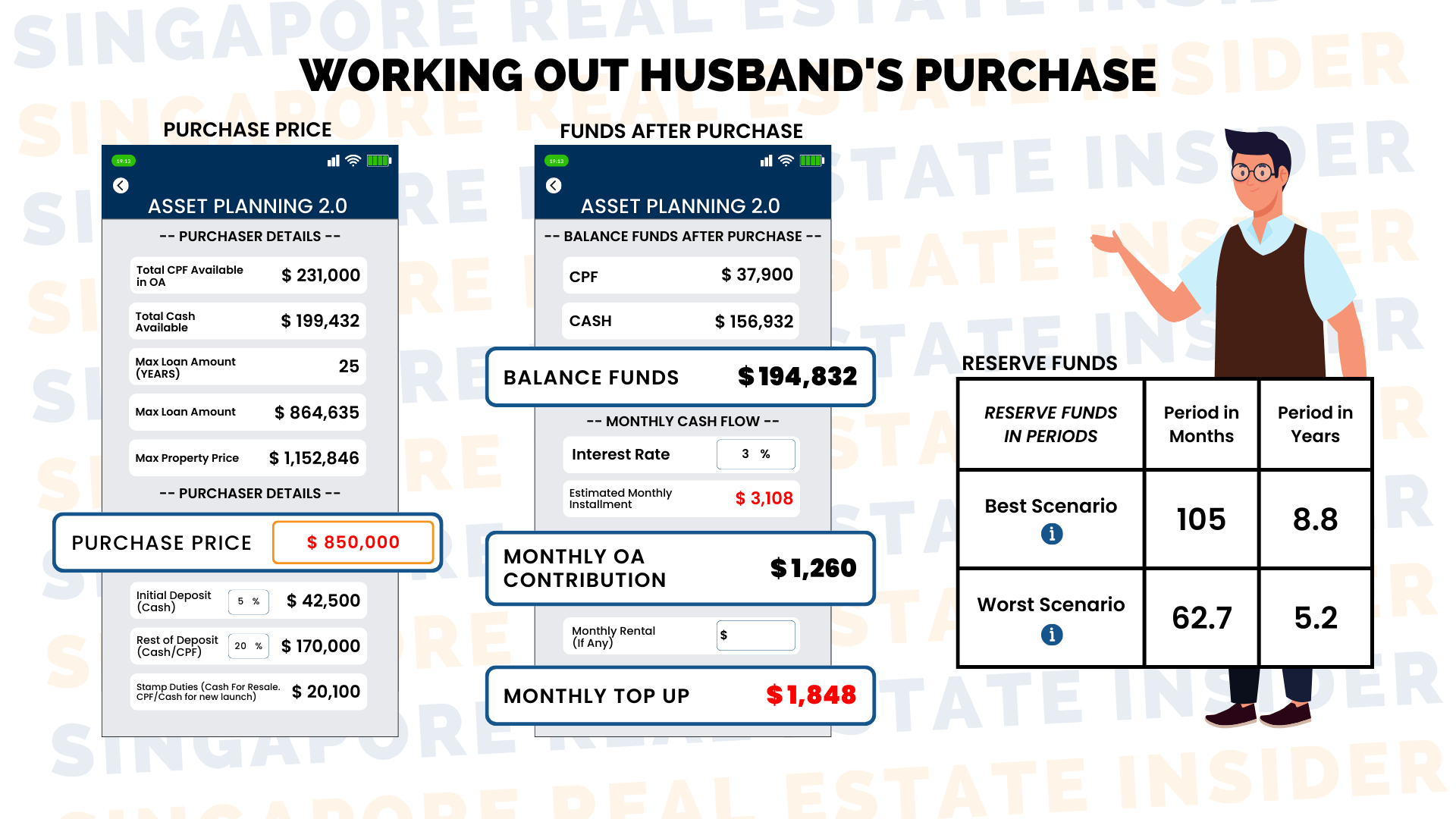

Your maximum loan amount is $864,635 for 25 years and maximum property limit would be $1,152,846.

Math time based on a very comfortable purchase without overleveraged, the purchase amount of $850,000 will be very safe!

And by doing that, you still have a balance fund of $194,832.. Why do we keep this amount aside?

This is for rainy days as a safety net. The last thing you want after purchasing a property is when you fully leverage it. Because there is a risk that you will not be able to pay the monthly installment if anything happens to your job or the family.

By planning this, this is a very safe approach to own 2 properties.

And to assume that his monthly cash flow goes around at:

Interest rate: 3%

Estimated monthly installment: $3,108

Monthly top up is only $1848 after deducting your OA of $1,260 every month.

So even if you do a low rent of $2,500, you still get a positive cash flow of $652 monthly.

For his reserve funds, the best case scenario is 105 months, or 8.8 years, and the worst would be 62.7 months or 5.2 years.

Which means even if you intend to take sabbatical leave for a long period of time due to whatever reason, you no need to worry about your property mortgage at all.

Reserve funds as your Safety net is extremely important and that is the reason we factor in our discussion, built it into our assessment with clients to ensure we do not overleverage and have buffer to continue pay for the property even in the worst-case scenarios.

Do you feel safer if you are just like the examples to acquire property within your means?

Let me just point this out: no matter how hard we work and save, it is still exponentially beneficial to let your hard-earned money work for you by investing in property.

And this is where Singapore Real Estate Insider wants to step in: helping busy professionals like you to make wise decisions that will prepare you for the future.

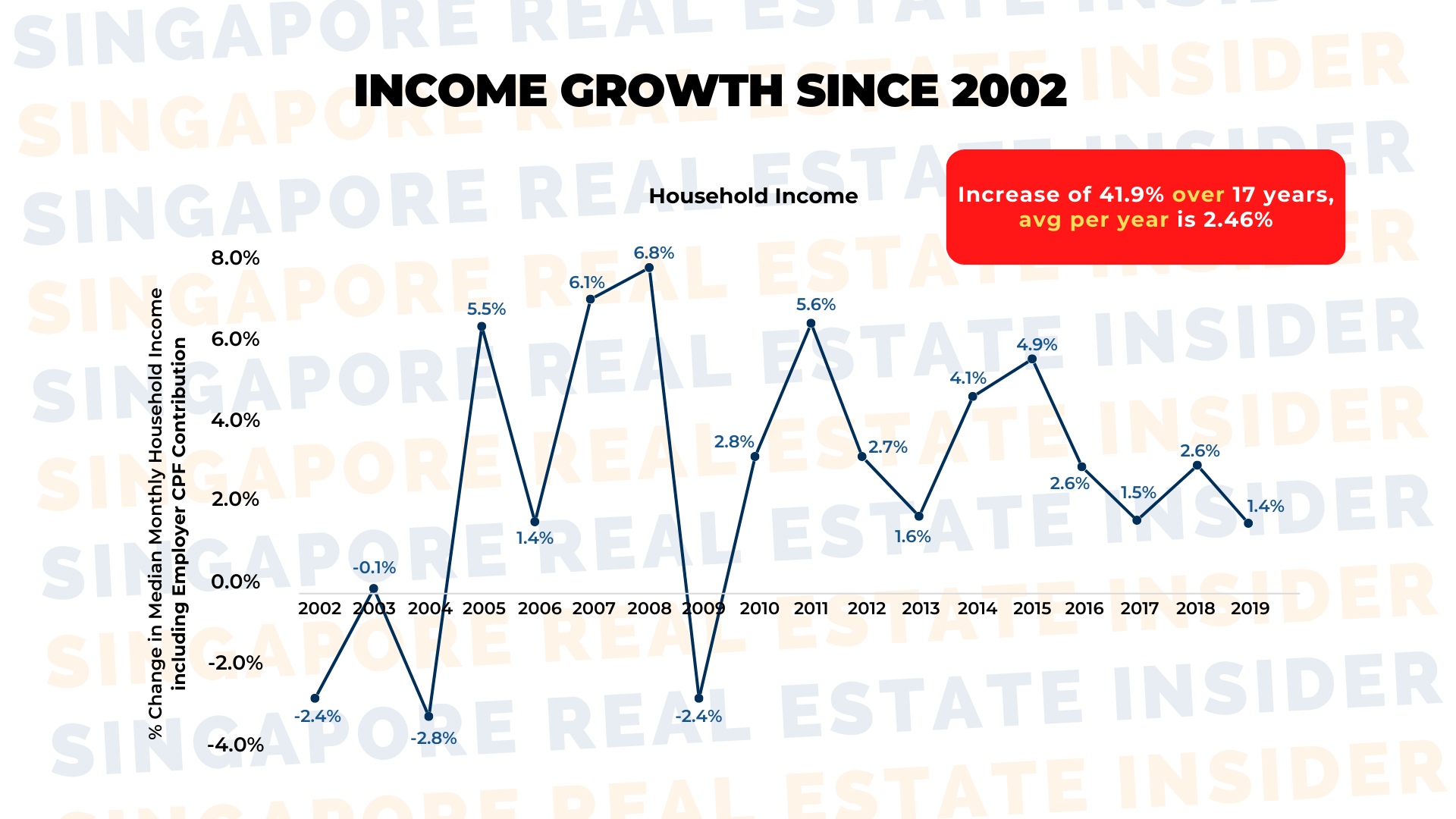

By the way, when was the last time you checked on your year on year increase of your salary? Do you track and understand how much increase you get?

Did you know that the average income growth is at a disappointing rate of 2.4% per year? Now compare that to those who make $300,000 in four years by investing in properties? WOW! That's how you can work smart!

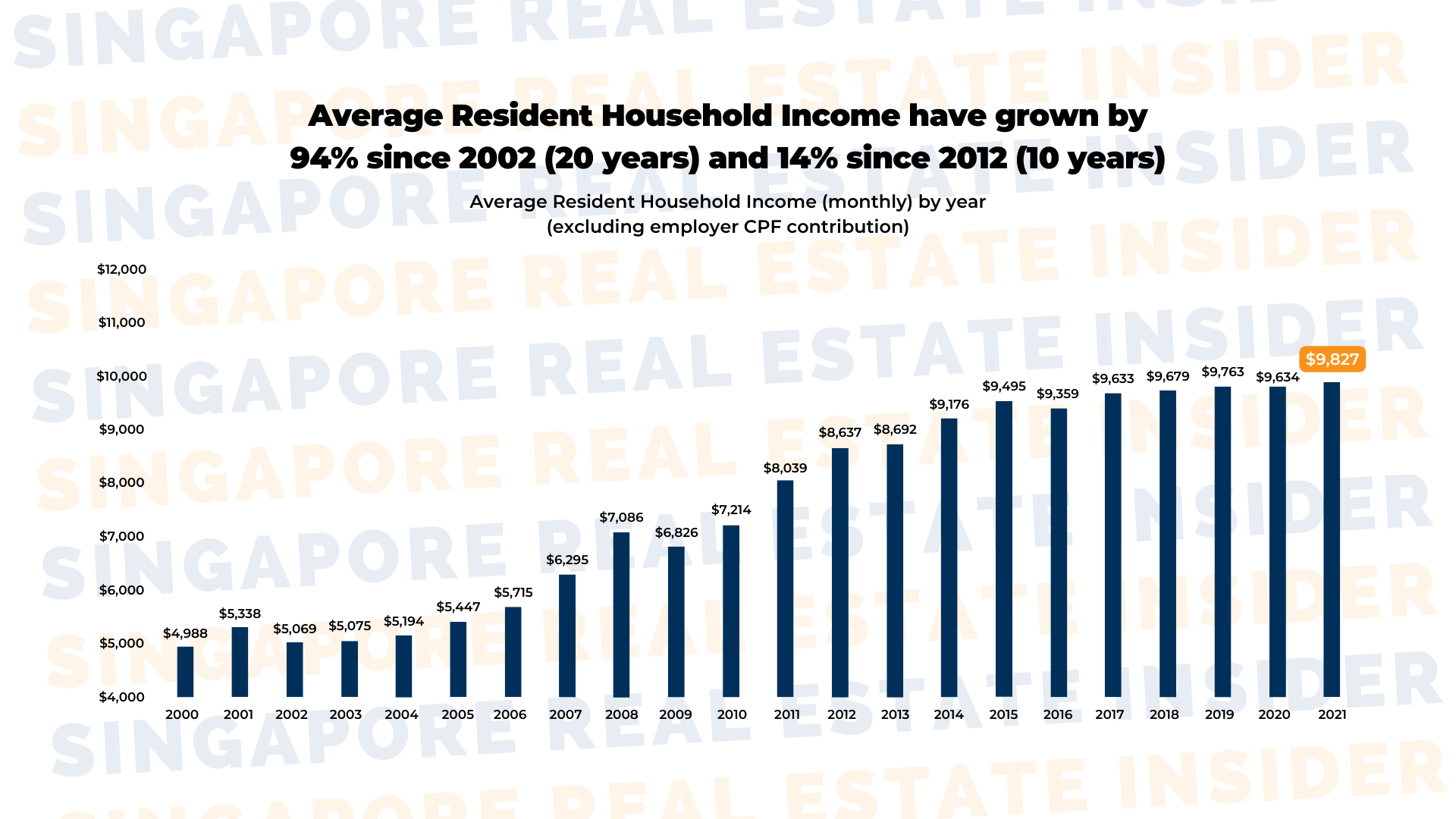

Although income amounts in general are on the rise, the rate of increase is slower when compared to property growth.

The pace is slowing down when compared to the last 20 years since 2002 and current times for the last 10 years since 2012.

A huge gap of difference don’t you think?

Now, let’s look at the figures of two similar condo units. Note that they are in different locations but are equal in terms of target market and value. Notice that in less than five years, the prices have gone up? This shows us one fact: we don't realize we're losing so many opportunities when we don't act right now! YIKES!

You may say, "You know, Edmund, I work for a generous company, and they give us bonuses throughout the year! I think we're fine."

First of all, that's great! But consider, will you be able to actually save them? And if you do, does it come close to what you could possibly earn by investing? How long will it take you to save that $300,000 from five years of investment if you stick to the standard earning and saving?

I have good news for you: you-yes-you! You can enjoy that, too!

With Singapore Real Estate Insider, we have unlocked the formula for making the right and timely investments through research and data so everyone, including busy professionals like you, can make the most of their money safely. Reach out to us to learn more, and let's reach your financial goals together.