Here is your part 2! If you haven’t read the first article about the Built-in price protection, click here to go read that first, then come back when you are done.

We are down to our FINAL 3. Let’s Go!

4. Profit. How much profit do you want to earn from your property investment? Your answer to this question will dictate your holding period.

It's the period from the day of purchase to selling, and exiting the market at the right time plays a significant role in securing your desired profit--and there's a math to it.

The most common real estate purchase scenario would require a loan with accrued interest and other fees spread over years of payment. Let's look at two examples:

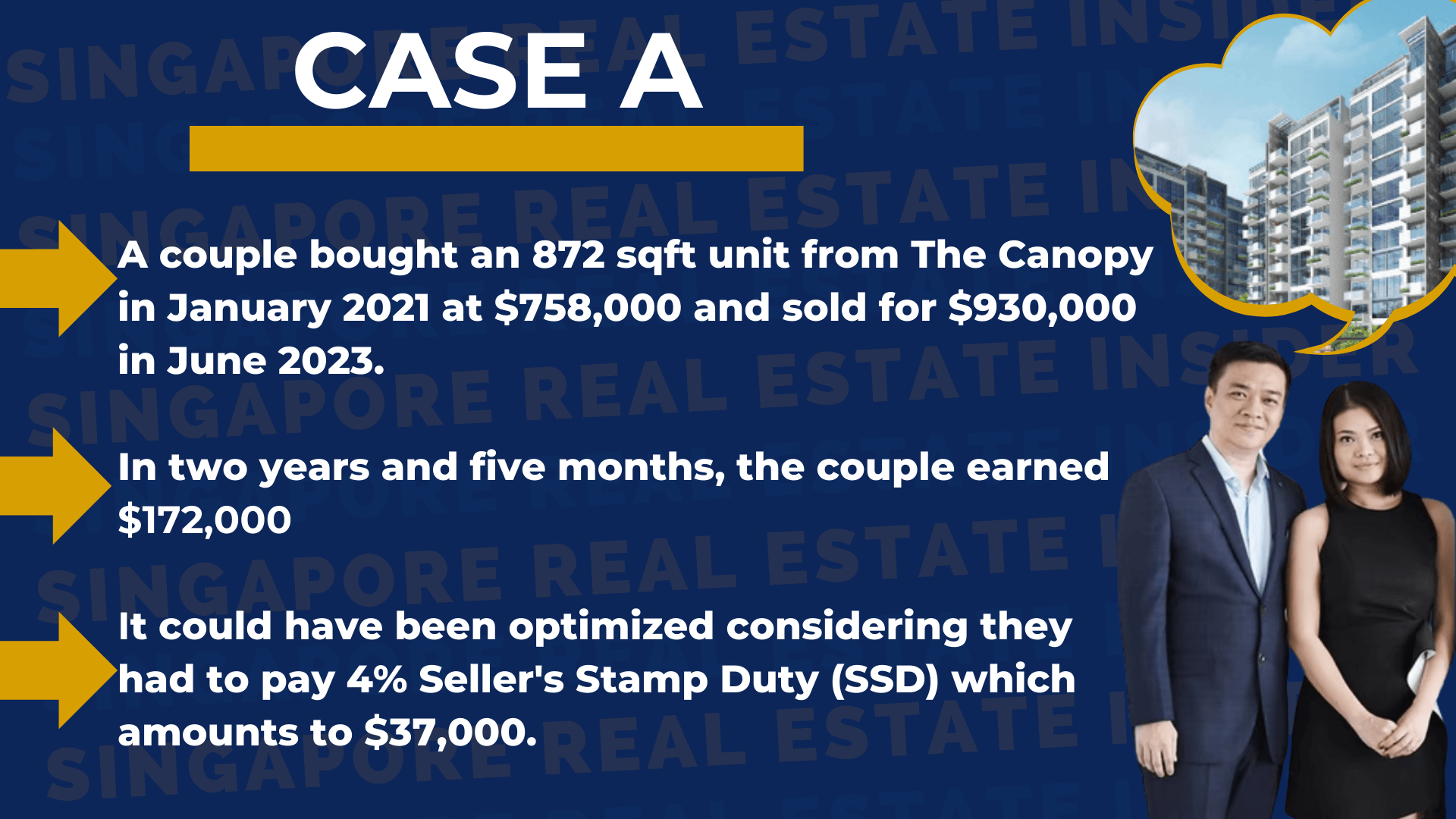

THIS IS CASE A -

2-Year Holding Period: The Canopy

A couple bought an 872 sqft unit from The Canopy in January 2021 at $758,000 and sold for $930,000 in June 2023.

In two years and five months, the couple earned $172,000--not bad, from an investor's standpoint.

However, it could have been optimized, considering they had to pay 4% Seller's Stamp Duty (SSD), which amounts to S$37,200.

They had to cover the costs of selling their property, stamp duties, legal fees, and commissions.

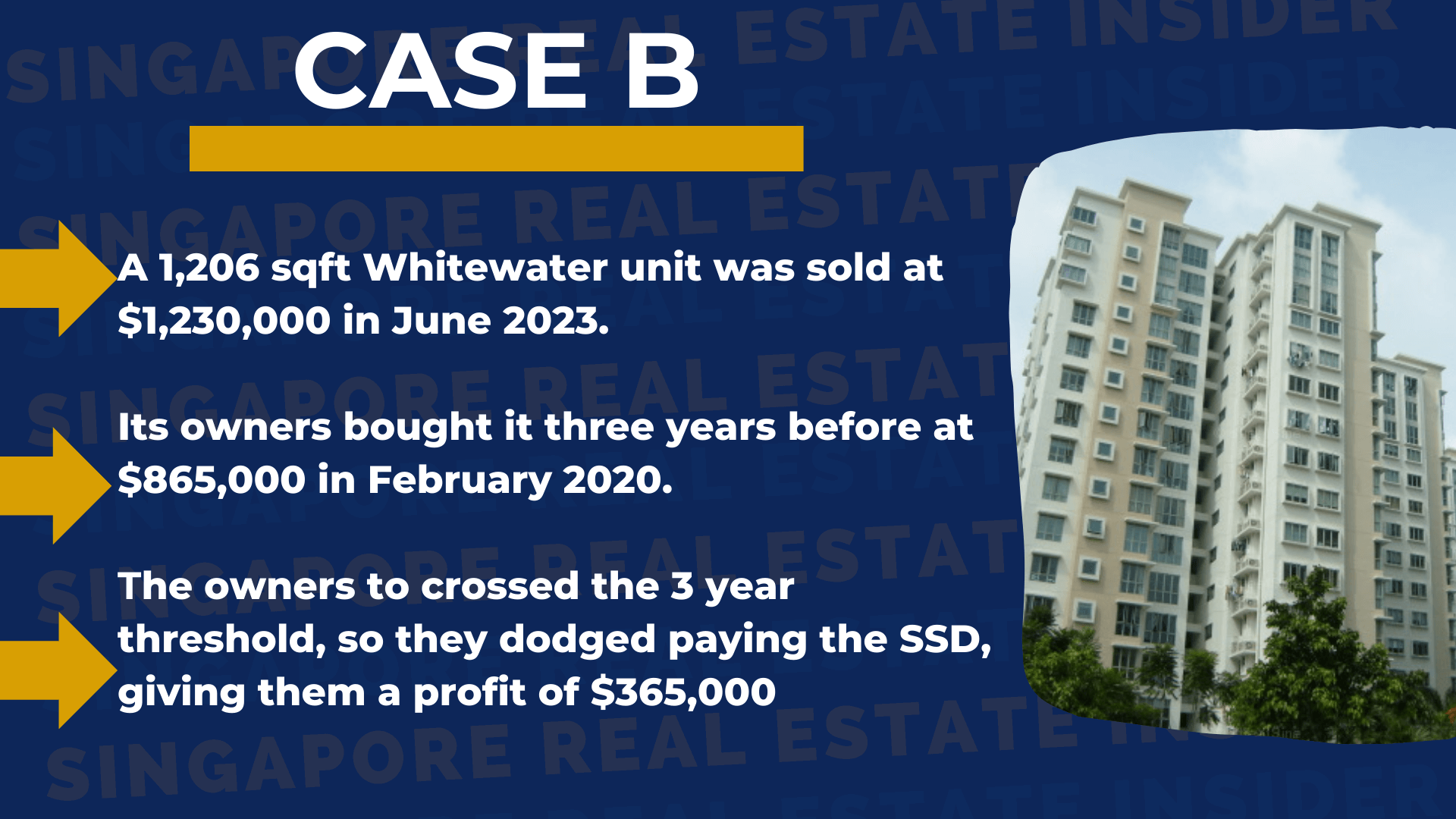

NOW, LET’S COMPARE THIS WITH CASE B -

3-Year Holding Period: Whitewater

A 1,206 sqft Whitewater unit was sold at $1,230,000 in June 2023.

Its owners bought it three years before at $865,000 in February 2020.

One smart move the owners did was to cross the three-year threshold, so they dodged paying the SSD, giving them a profit of $365,000, which had more room to cover the other expenses that went into selling the property.

It seems like both owners made sound choices right? But which one do you think - dodged the bullet?

5. New launch vs. resale. Discern what's best for your goal: new launch properties or resale properties? There's no one-size-fits all, because it depends what type of investment you intend it to be.

For property flipping, the common practice is to buy during pre-launch and sell as it TOPs. Buying a brand-new unit is ideal for selling because:

- You're buying the unit at its lowest price

- Brand new development with new materials and innovation

- Low to zero maintenance cost (prior to selling)

- More unit options

As for those who want a steady flow of rental income, it's recommended to go for a resale unit, provided that you'll practice due diligence in inspecting the property's condition, assessing the location's potential, and calculating the expenses vs. income. Here's why resale units are ideal for seasoned landlords: You can rent out the place right away.

Easier to pinpoint the right rental fee because all you have to do is look at the current rental rate within the development.

More chances of scoring under-priced units for resale.

Remember, you can’t have it all - and discerning your goals and risk-appetite is crucial when you are aiming to dive into this type of property market.

AND SPEAKING OF, the last and ultimately most important factor - THE PROPERTY MARKET ITSELF.

6. Property market. Most of the biggest sales this year can be attributed to the good property market conditions today.

Growth in the Singapore real estate market has been steady despite the pandemic, and people still keep on buying despite the high prices and interest rates.

Property investing isn't entirely a piece of cake, if you want to secure the best portfolio or income for yourself. It takes much research, analyzing data, and having a good sense of how the market is performing and seeing how it could grow in the coming years.

At Singapore Real Estate Insider, we have helped so many busy professionals in realizing their property investment dreams safely with the help of The R.E.I. Method.

Make informed decisions, future-proof your property journey, and get the first-mover advantage.

Are you ready to start building your dreams? Contact me today! Click here to book your complimentary 20-min call with me.

Invest wisely, and stay tuned!