Do you wish to buy a second home but are concerned about the extra money required to cover the ABSD?

Isn't it inconvenient to spend money you could be using for something else? A new phone perhaps or maybe even a mini stay-cation.

Sure, buying a second home sounds nice but what if that dream flat becomes the source of nightmares - The financial kind, of course.

Let’s talk about ABSD and whether or not you should pay it for a second property. In short, IS IT WORTH IT?

Deciding whether or not to purchase a second property even with the Additional Buyer's Stamp Duty (ABSD) - is like a blue or red pill situation.Both options have their perks and their consequences.

Let me put this into perspective.

I recently met a family who have resided in their HDB for nearly 18 years.

They find themselves at a crossroads, contemplating the purchase of a second property despite the associated ABSD, mainly due to their emotional attachment to their HDB.

Sentimental Values are valid - I have no issues with that. BUT — we also need to go back to a practical stand-point.

The new ABSD rates are not CHEAP!

We all know that Singapore has introduced new cooling measures for the Singapore property market to ensure SUSTAINABILITY.

Despite previous measures, the government aims to moderate property prices, which showed signs of accelerating.

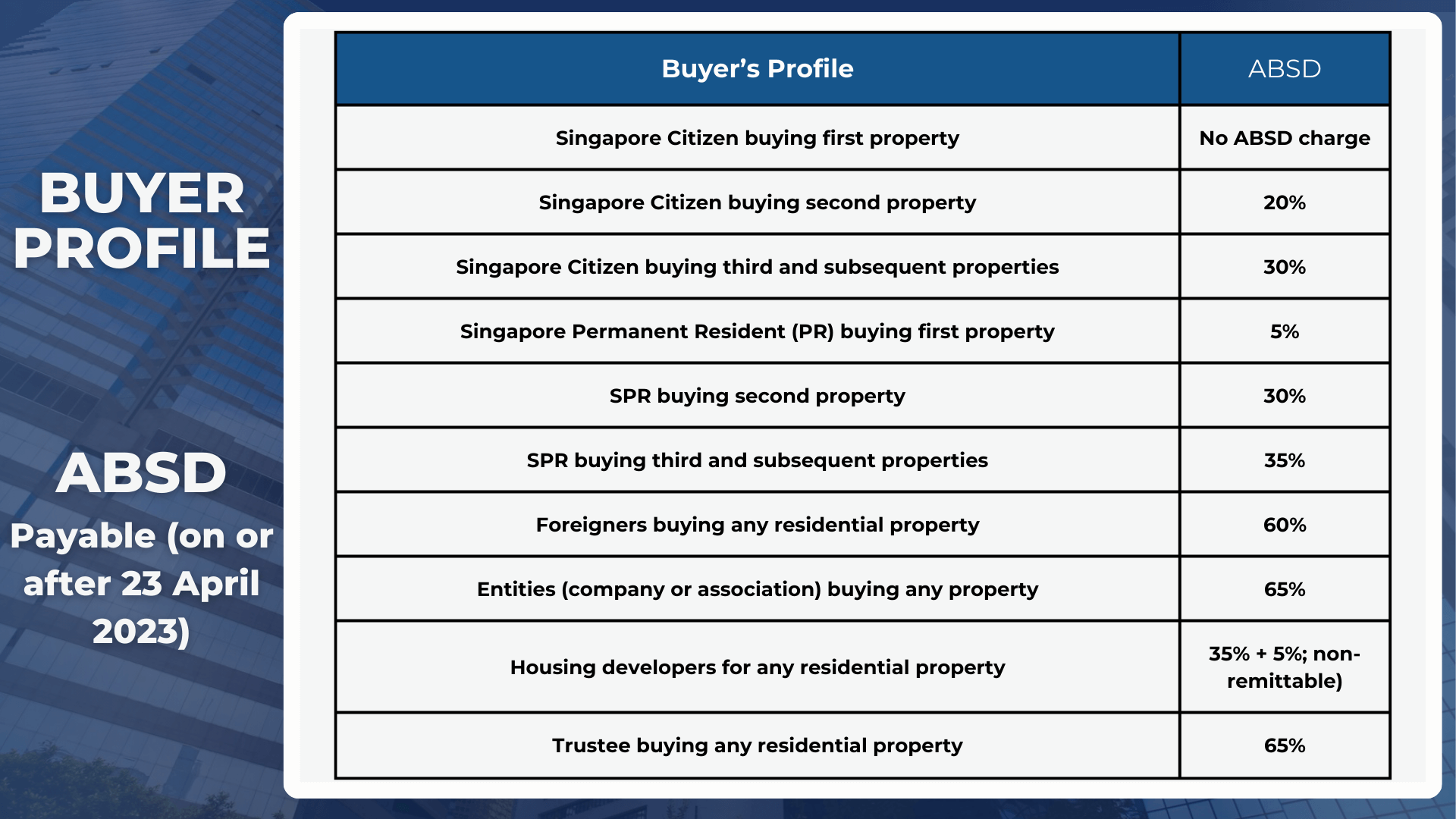

The Additional Buyer's Stamp Duty (ABSD) rates have been increased for various groups of buyers.

Foreigners purchasing residential properties will now face a 60% ABSD, up from 30%.

Singapore citizens buying their second property will see the rate rise from 17% to 20%, and further increases will apply for subsequent properties.

Singapore permanent residents (PRs) also face 5% rates.

Entities purchasing properties will pay 65% ABSD now.

These changes are a response to the growing demand from both local and foreign buyers and the potential risk of price increases that outpace economic fundamentals.

The increases will impact about 10% of property transactions based on 2022 data.

This marks the third round of cooling measures in the past 16 months.

BUT AGAIN, it's the only way to keep everything afloat. And That’s why -

The government plans to align policies with market needs to ensure a sustainable property market.

So, should you get a second property? Nope, don’t answer that yet - I’m pretty sure you haven’t got the full picture.

Here are some key factors that come into play if you buy a second property with ABSD:

1. The ABSD Rate on Second Property

The ABSD rate for a second property is 20%. This additional cost should be factored into your decision-making process. Stop - check your wallet - and see if this can already break your bank.

2. Loan and Cash Component

If you still have an outstanding loan for your first property, you're limited to a maximum loan of 45% for the second property.

Additionally, a 25% cash component for the deposit is required.

And because of those limitations - this arrangement often leaves you with a restricted budget when considering the purchase of a second property.

3. Impact on Property Choice

Given the financial constraints brought about by ABSD and the loan limitations, second property purchases often lean towards smaller units like 1-bedroom apartments.

However, it's worth noting that the long-term performance of such small units may not be as favorable.

4. Our practical standpoint - Recovery of ABSD

If you decide to pay the ABSD, it's important to assess how long it will take to recover the additional 20% tax.

For instance, if you paid $200,000 in ABSD for a $1 million property, you'd need to rent out the property at $3,000 per month for at least 5 years just to recoup this amount.

This recovery period is quite substantial, nearing the Minimum Occupation Period (MOP) of an HDB flat.

5. Consideration of Additional Costs

Beyond ABSD, there are other costs to factor in, such as legal fees, maintenance expenses, and more.

These can further impact the financial feasibility of purchasing a second property.

6. Personal Experience and Attachment

Drawing from personal experience, I can relate to the comfort of remaining in an HDB flat that holds sentimental value. However, unforeseen circumstances can lead to a change in plans.

In my case, unexpected events prompted us to sell our HDB and transition to a different property.

7. Freedom and Property Options

Paying ABSD could potentially limit the types of properties you can afford, narrowing down your choices.

By unlocking the funds tied up in the sale of your HDB, you gain the freedom to explore a wider range of property options that align with your family's needs.

In Conclusion

The full-picture has now been laid out and it is now up to you to decide if it’s worth the cost.

Afterall, it’s your money, your gains, and your move.

In the end, the decision to pay ABSD hinges on your objectives and the goals you have set for your property journey.

While emotional attachment to a property is understandable, evaluating its financial implications will have long-term prospects before making a choice.

And if that choice is too hard to make, then we can help you move forward.