Have you ever heard of the phrase “ When there’s smoke, there’s fire?” - It’s a simple idiom that something is wrong. But what do you do if the smoke comes from the property market? You GET OUT!

It's a common misconception to think that once you’ve bought a property, you’re settled for life. This belief has eluded people into banking their investments into an all-or-nothing aspect. But it's not supposed to be this way - investing in real estate is not a rich man’s game, but a smart ones. You should know when to quit, and when to jump.

And right now, I’m going to be teaching you how to handle the former.

How we can look at the best time to sell a property and to hit that six-figure capital safely!

This is one major factor to remember if

you are planning to sell a property - Transformation is a game changer when it comes to making the most of your property investment.

It directly impacts the property demand within an area.

So, if you know what things are in the works in your location, i.e. future demand trends, it will give you a bigger chance to win in your exit.

Do you know of any major transformation plans happening around your location or in Singapore that will be the talk of the town for the next 10 years?

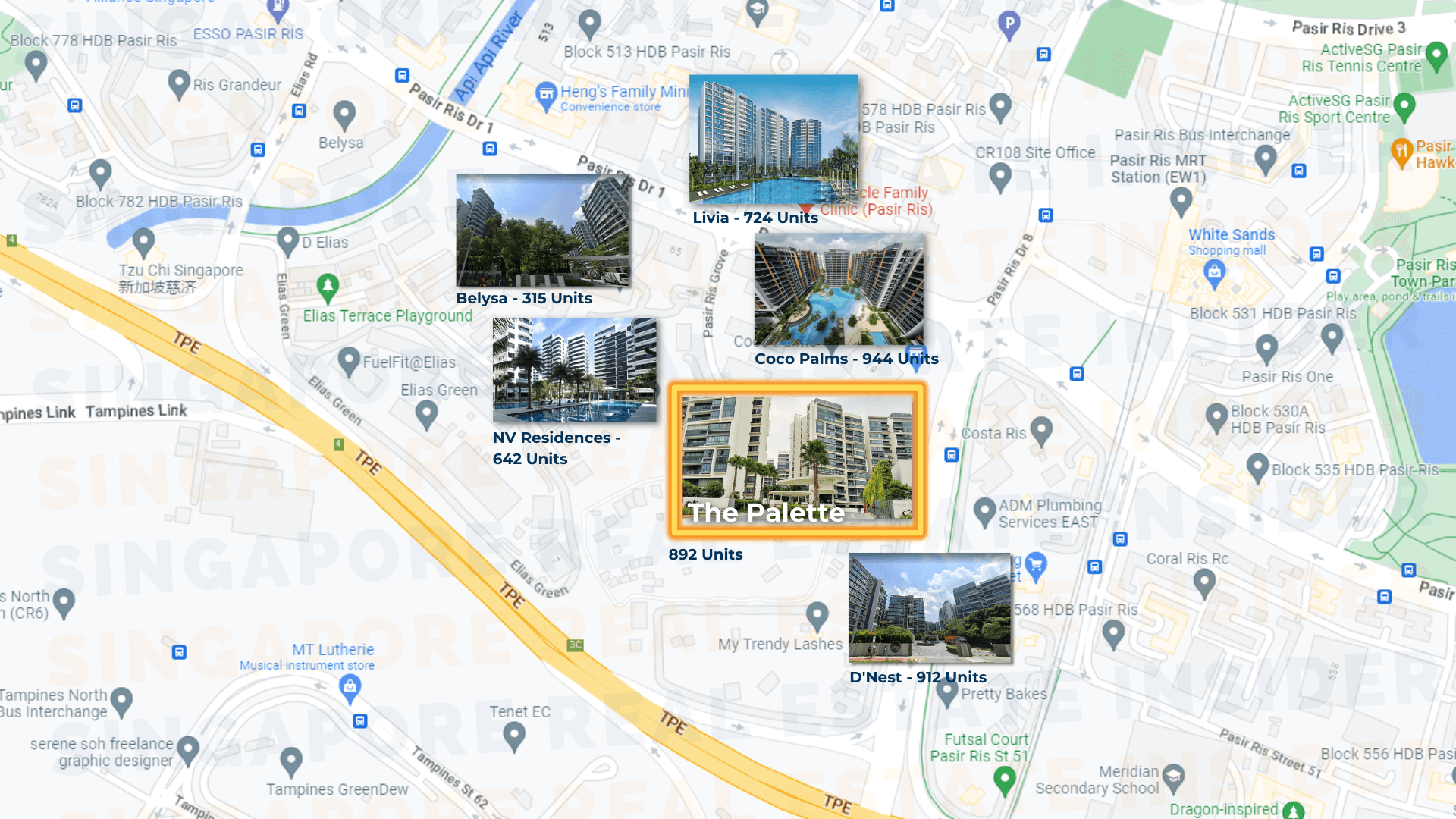

To emphasize on my previous point, Let's do a quick analysis at Palette in Pasir Ris.

It's a development surrounded by other condos.

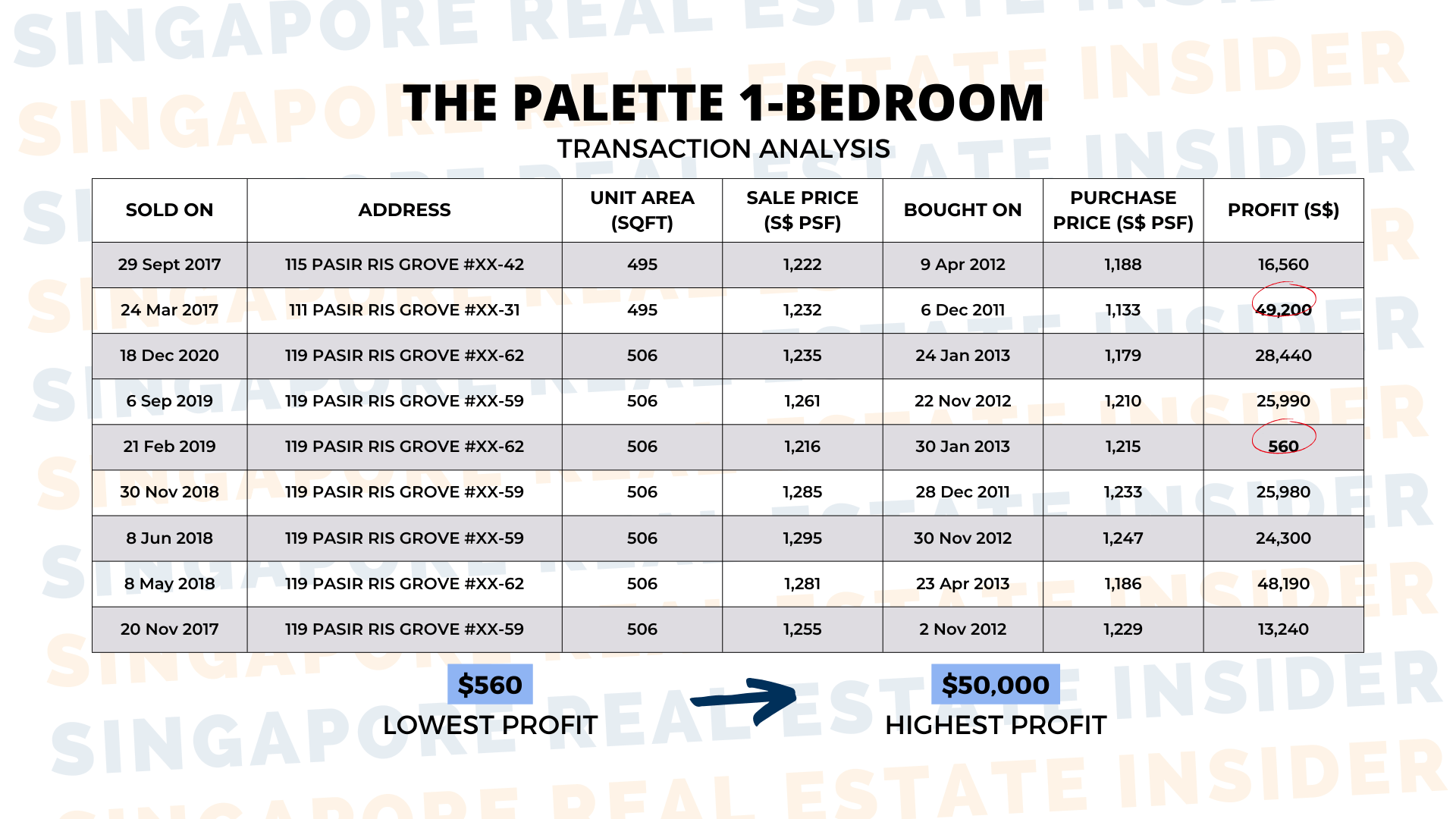

If you look closely within the data below, you will notice that profits go from $560 to $50,000.

Doesn't it beg the question, why do 1-bedroom profits sell so low?

The root cause is D'Nest and Coco Palm's combined 1-bedroom unit supply is a HUGE 295 units in total.

Their layouts don't differ too much. But the thing is, when these two TOPed, buyer behaviors tend to favor the newer units.

That is why Palette, being an older property, suffered a lower value.

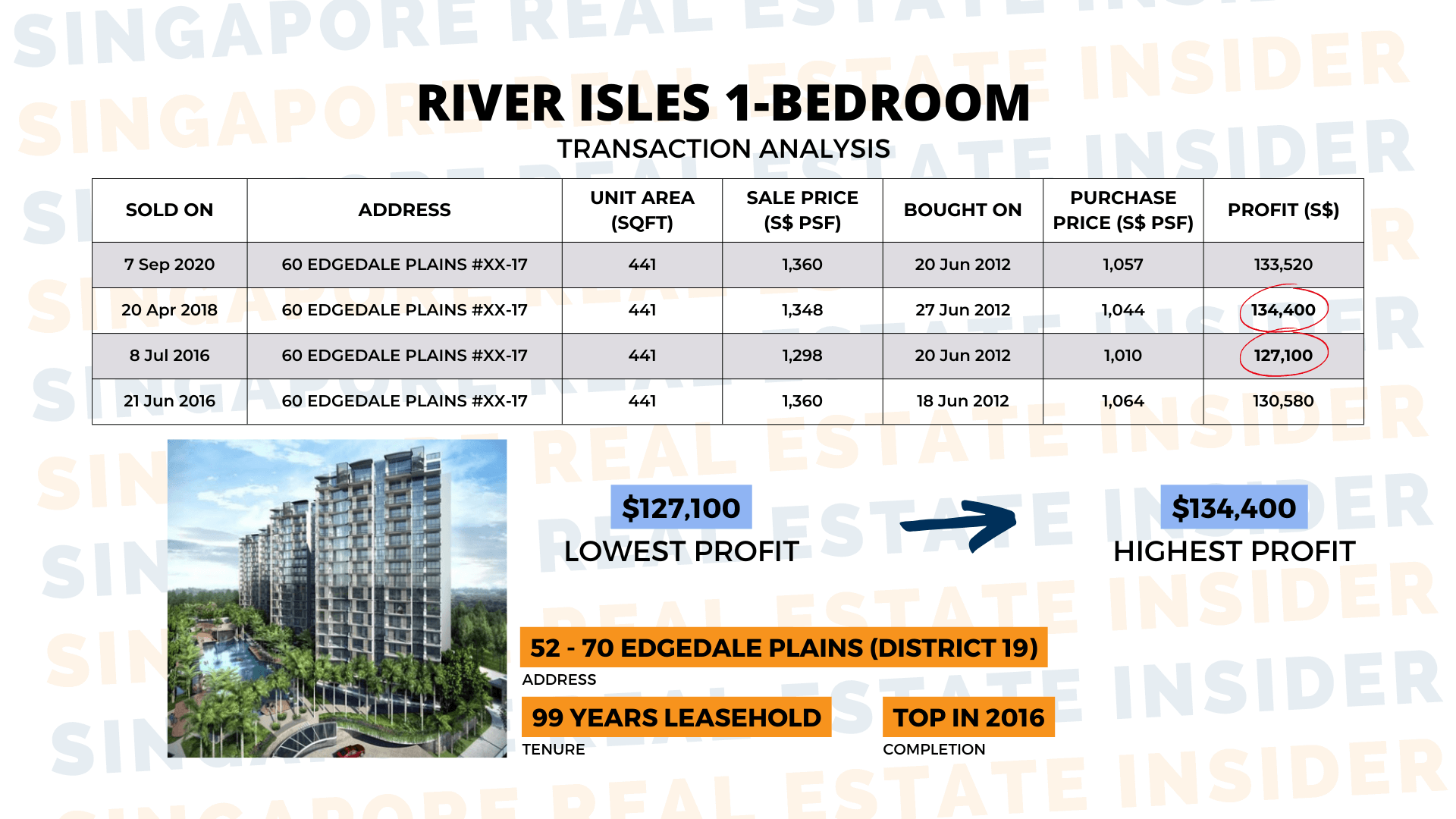

Now, let's move on to the River Isles in Punggol.

Their 1-bedroom units' profits ranged between $127,000 to about $130,000.

Despite the similar purchase date in Palette, River Isles had a higher profit margin because of the Executive Condos surrounding it, which means that 1-bedroom units are scarce.

Always remember the basic fundamentals.

When there's supply, the price comes down. When there's limited supply, the price goes up. With this, it is clear that the supply of certain units within an area is important to ensure a better profit.

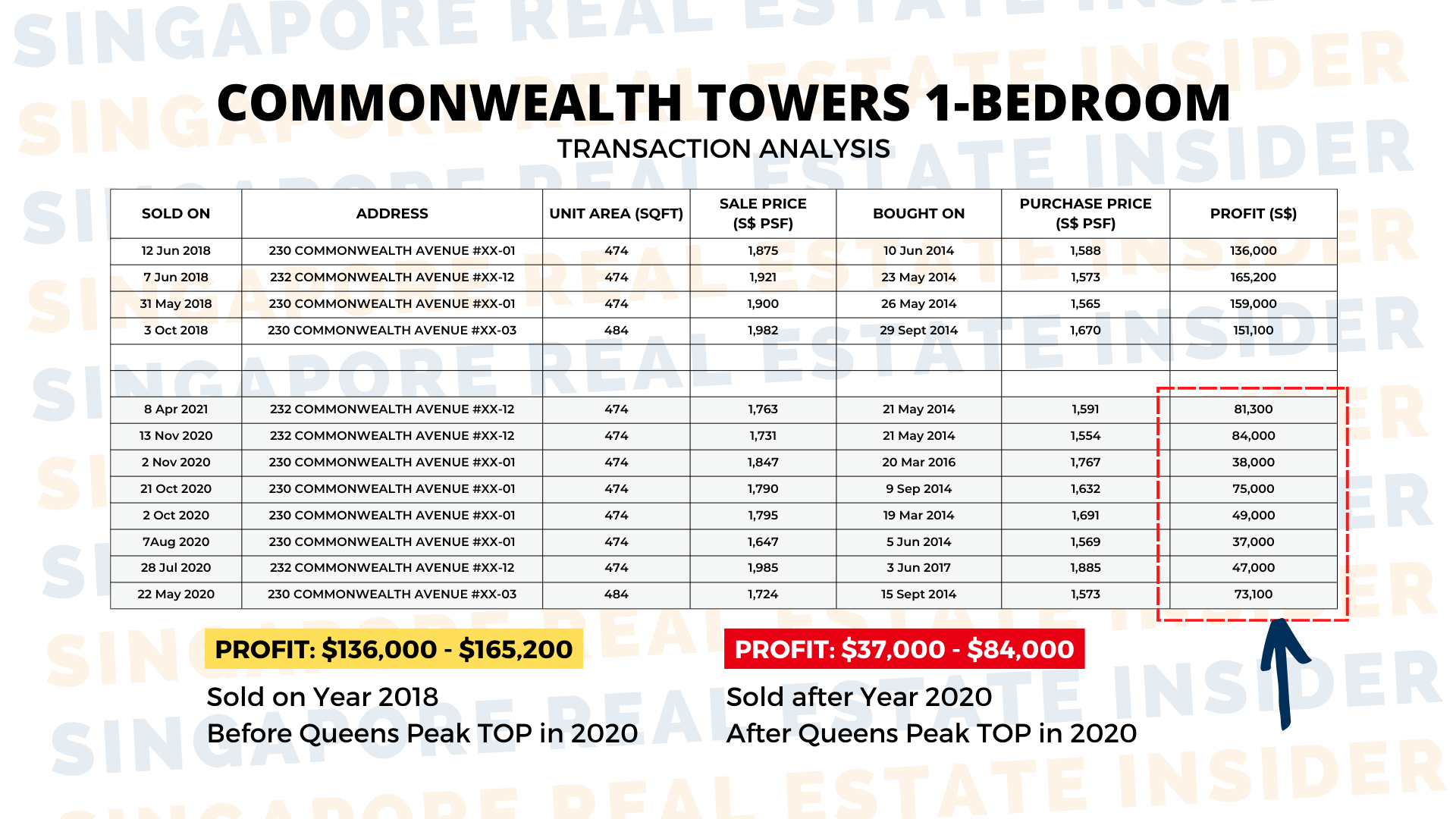

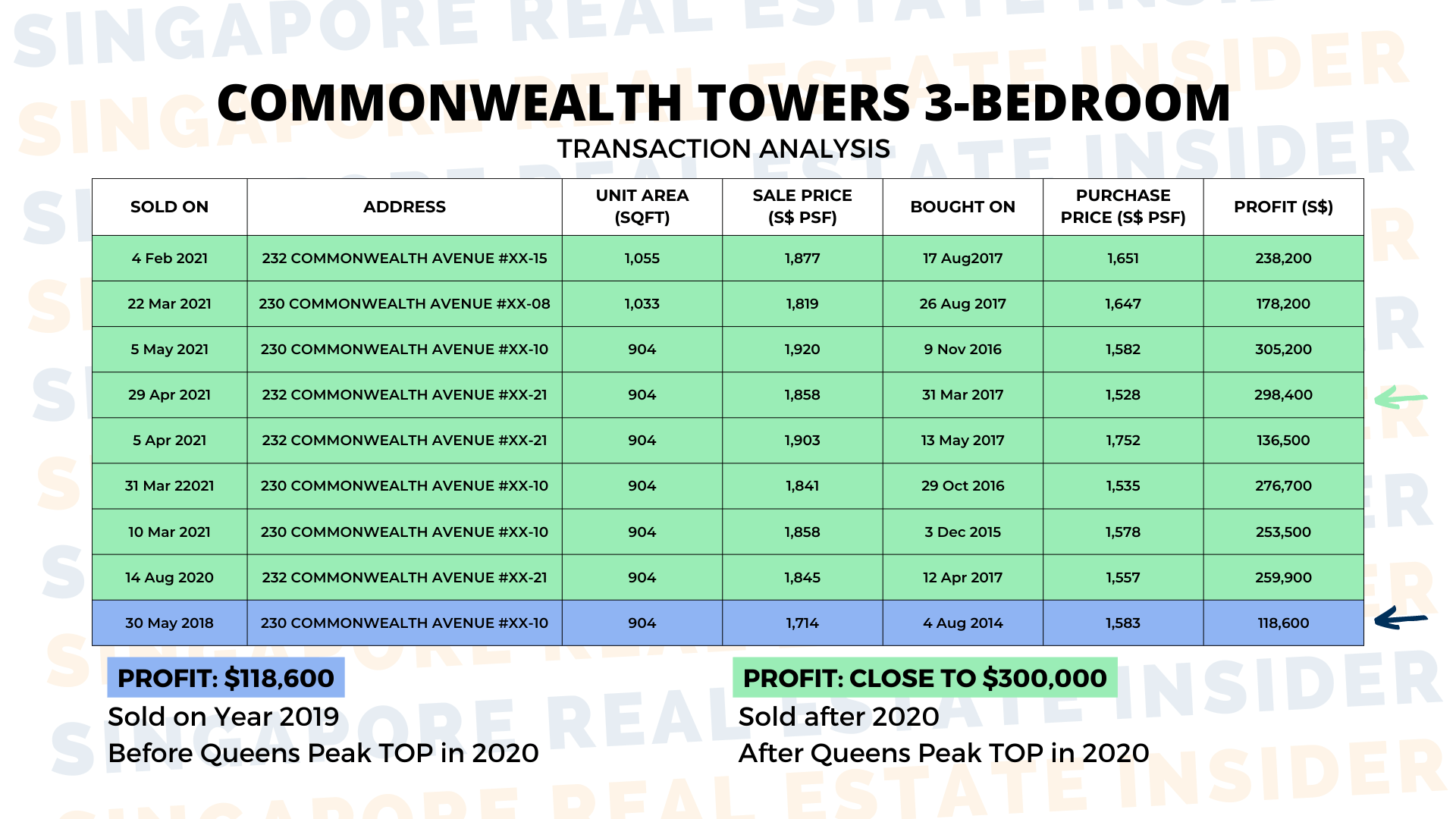

Let's look at another example: Queens Peak and Commonwealth Towers.

Queens Peak was already earning between $130,000 to $160,00 even before it TOPed in 2018.

But look closely at the units sold in 2020 onwards -

You can see that the profit margin decreased from $35,000 to $80,000.

This is because Queen's Peak had 256 1-bedroom units and 261 3-bedroom units.

The 3-bedroom units performed better, profiting between $119,000 to $300,000 in 2020.

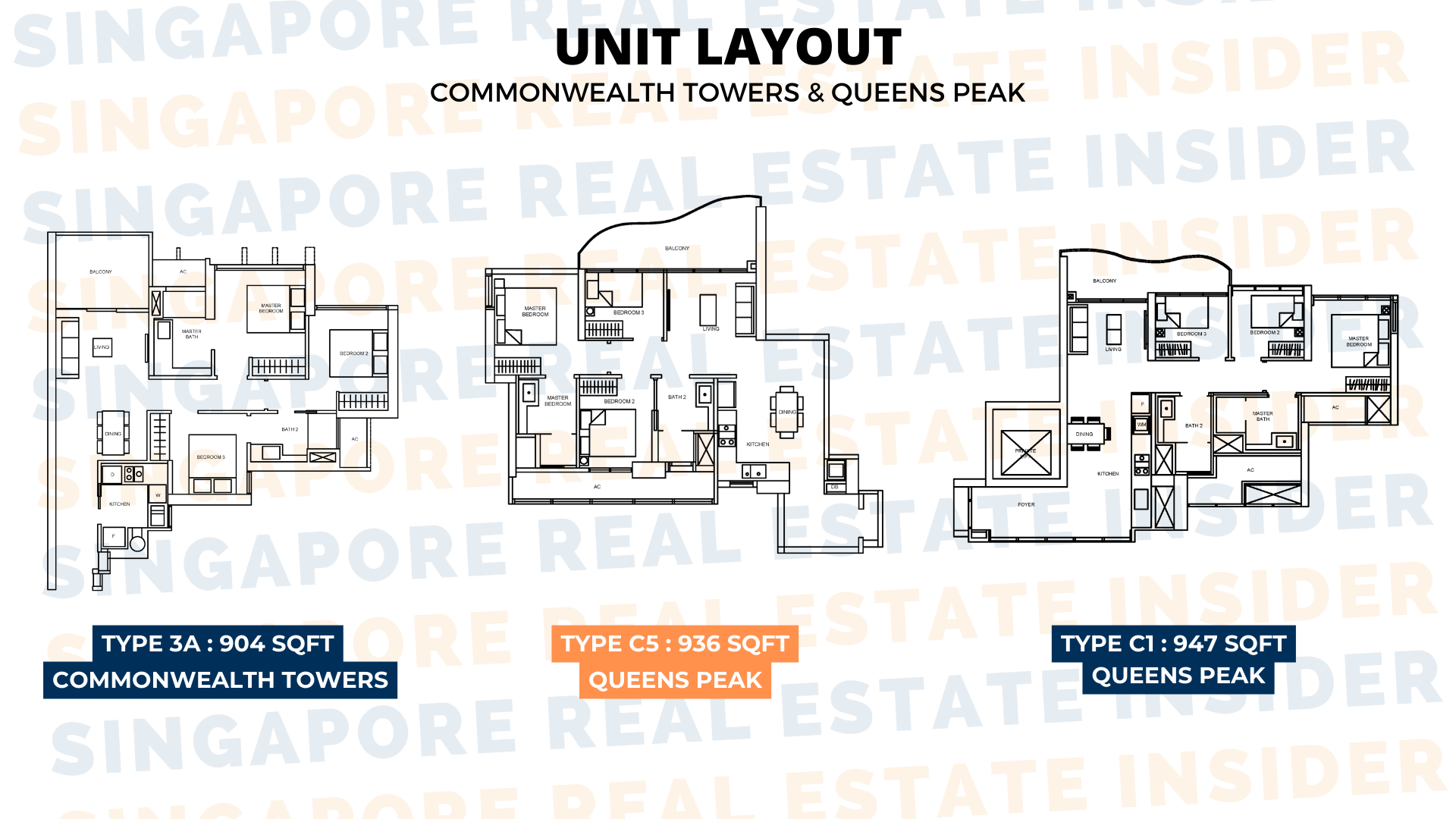

This is where the importance of layout comes in.

In the three floor plans, you can see Commonwealth Towers' 904 sq ft 3-bedroom units and Queens Peak's 936 sq ft unit.

I want you to pay attention to this key difference - Despite being the smallest in size, Commonwealth Towers' 3-bedroom unit has a smarter layout compared to its adversary.

Its spacious tactics - with an enclosed kitchen and three bedrooms that can accommodate queen-sized beds dominates the appeal compared to the Queen’s Peak.

Wherein its units could only fit a single bed.

This drove the demand for Commonwealth Towers' 3-bedroom unit sky-high.

So, it's not always about size in Real Estate, it’s also how a unit can cater to a buyer's wants and needs in the market.

Afterall, If I’m going to spend more than 100k - I will surely want to get my money's worth!

There are always 2 points you need to consider strongly before exiting the market.

1. The Upcoming property supply

2. And the property layout vs. the units surrounding your development.

Are you second-guessing your property exit?

Let me help you build a strong market exit strategy to ensure that six-figure profit is in the bag!

At Singapore Real Estate Insider, we want to see all of our clients succeed. That's why we go through a rigorous process with each one of them, from establishing their purposes and goals in investing, to financial planning to doing the math and backwork to sell at the right price and at the right time.

For all of your property investment concerns, you are welcome to contact me so we can plan this out together to reach your goals.

Click here for a complimentary 20-min consult with us.