Let me ask the question you have only kept to yourself up to now: "Is it good to buy properties right now? Even at its higher price?"

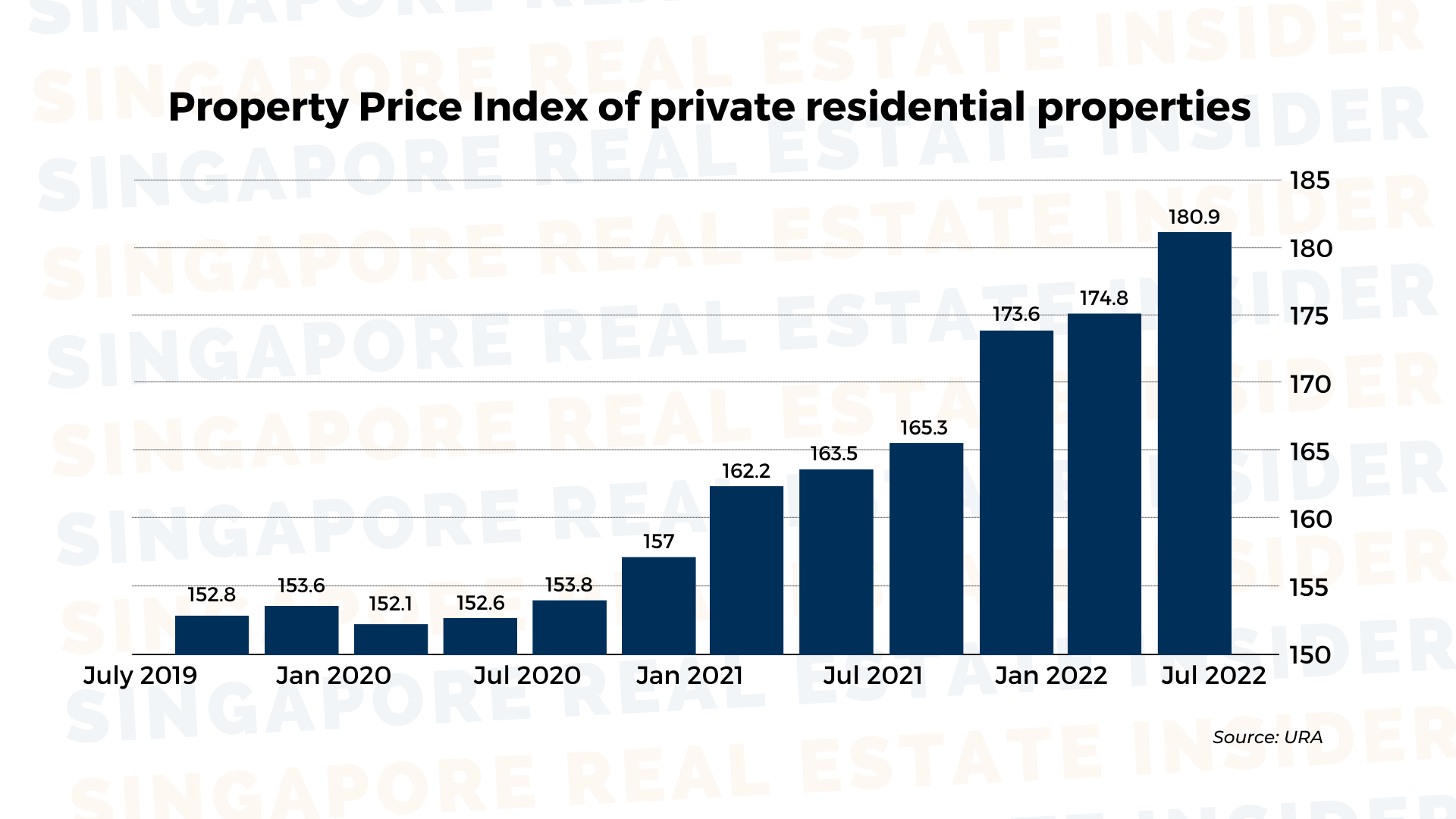

I invite you to look back at the property prices in the last decade.

According to Urban Redevelopment Authority, there has been a 0.7% price increase in private homes in just three months to March of 2022. Prior to this, there has been an average of 0.4% growth. You can also see the decline in prices from 2014 to early 2018, but a quick, sustained recovery afterward. Last year, private home prices rose by 10.6 percent, sharply picking up from

a 2.2 percent growth in 2020.

Am I Too Late to Purchase a Property Right Now?

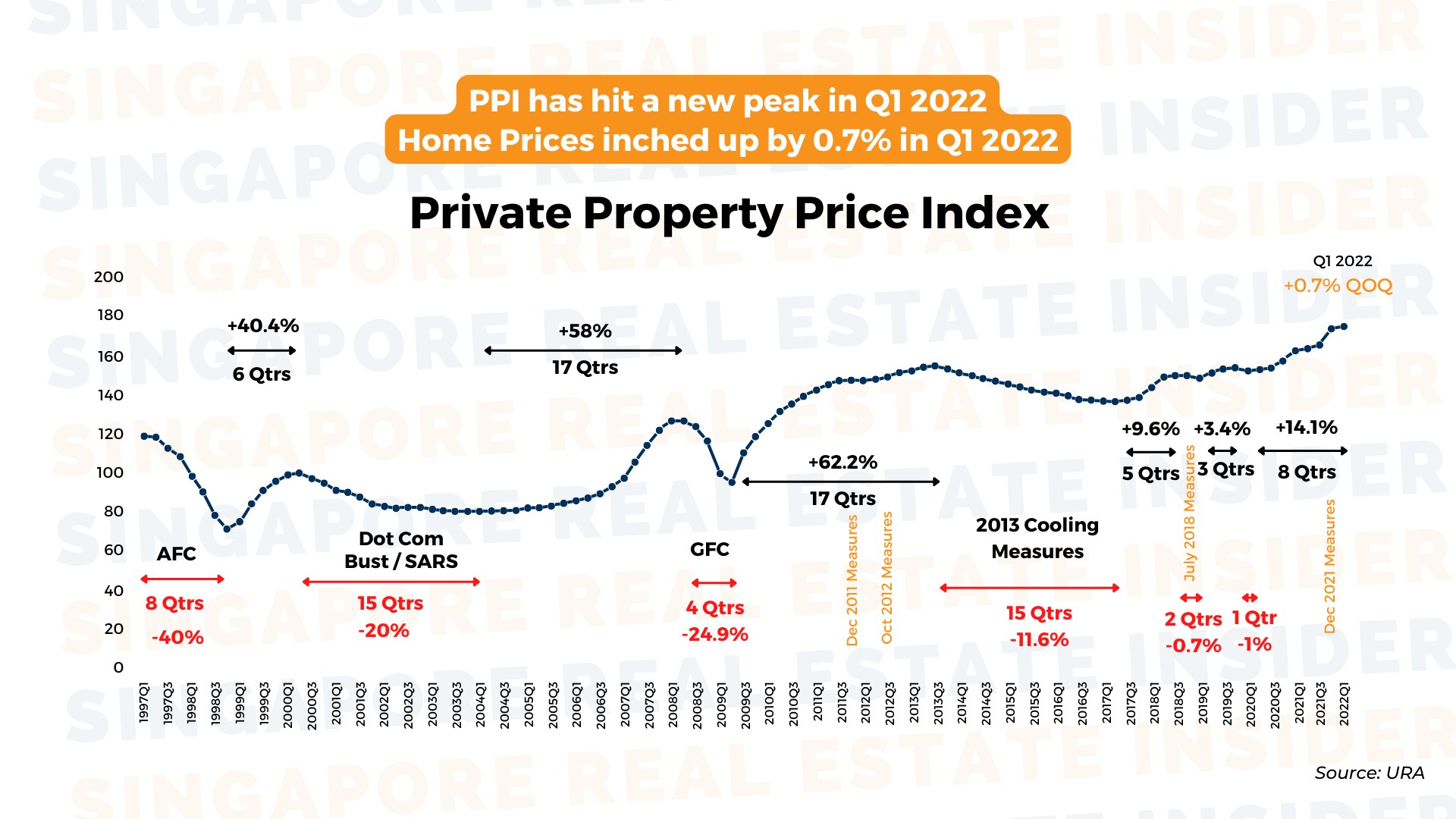

In 2009, many Singaporeans grabbed the opportunity to purchase a home at low rates, thanks to the global financial crisis. Back then, the economy made strategic moves to recover by keeping interest rates and buyer's stamp duty low.

Next thing you know, citizens were met by a 62% increase in just 17 quarters. In 2017, the government imposed a 5% ABSD to cool down the market. This intervention only allowed buyers to resell their property after four years.

2017 graced a slow growth in property prices but had a quick step on the increase as the economy strengthened by 2018 and private properties rose again by 9%. Ever the proactive government, Singapore rolled out another round of cooling measures to keep the property market under control.

Yet here is a curious thing: people continued to buy in 2020 after Covid-19 happened despite the craziness that was going around. I mentioned in my previous video that the primary driver of this growth in property sales is the need for bigger spaces, as most Singaporeans experienced work-from-home arrangements and online classes.

Those who bought properties in 2020 benefited from the 7.6% increase in property value in 2021.

If you observe the property price trends in the market, every dip in prices is higher than the previous dip, and every increase is even more higher than the last price hike.

That tells us to take a step back whenever we think about the right time to invest in real estate to see the long-term trend.

Since the country is scarce in land, you can expect that majority of property investors will not resell their assets at a low rate. The demand will always be high.

In 2006, South Bank launched and doubled their property values in 2007. However, the global financial crisis dragged this down by 30% at a neck-breaking speed. While some had to let go of their properties, never mind their losses. Yet those who held on for four years witnessed the growth from 2008 to 2012, enjoying a 58% increase in value. That's about $500,000 of profit despite the decline in 2007.

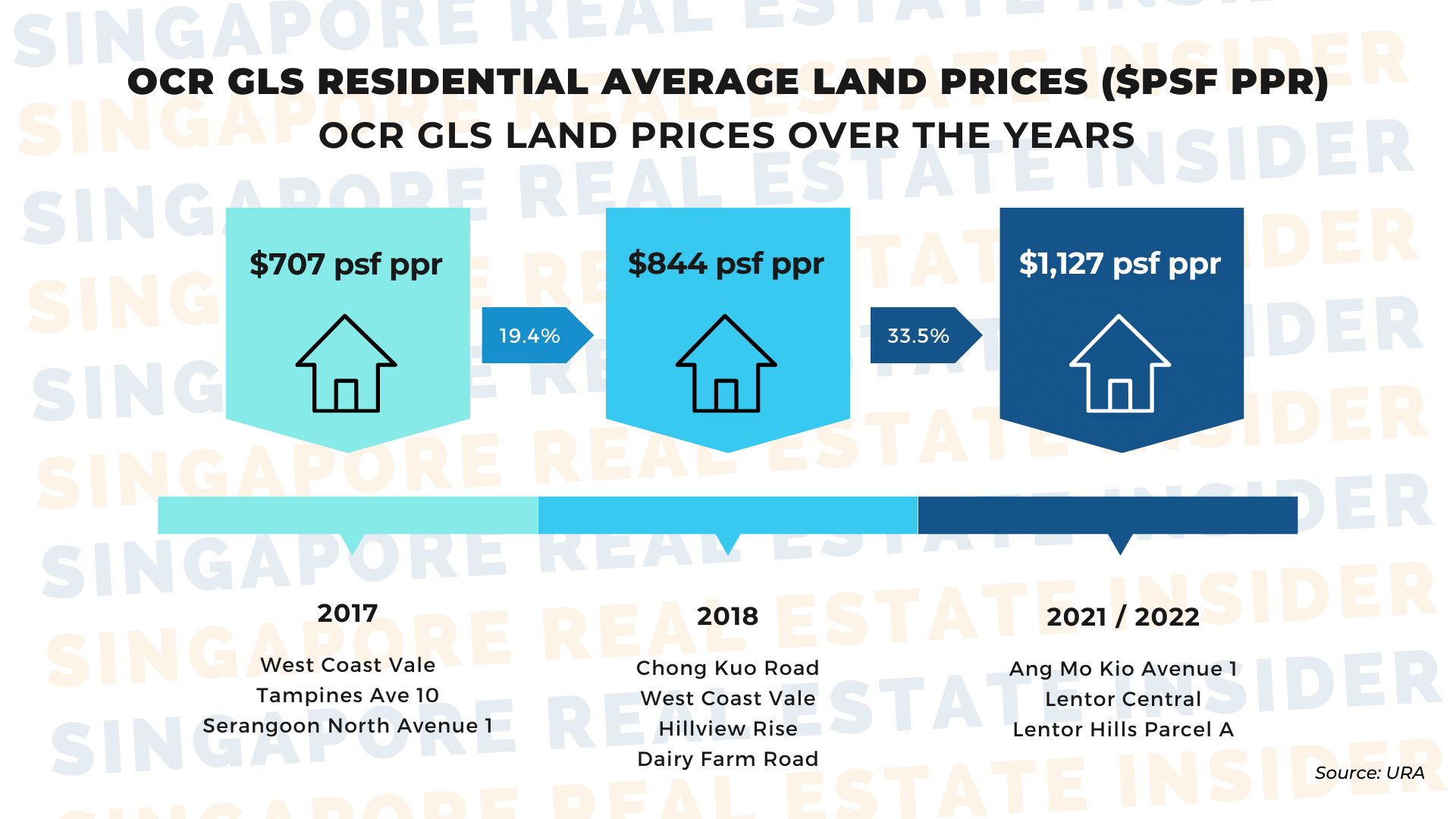

Look at the growth in land cost from 2017. Five years ago, the average land cost in OCR GLS was $717 psf. It rose to $844 psf in 2018, and then it's at an all-time high at $1161 psf in 2022. That's 37.5% growth!

In 2017, Parc Riviera sold its 3-bedroom units at $1,150,000. In 2021, Parc Clematis, just across the former sells its 3-bedroom units at $1,600,00. Can you imagine earning that much revenue in just five years?

What am I driving at? The answer to whether it's too late to purchase a property now is a resounding NO! When you invest in properties, the best time to buy, cliché as it sounds, is NOW. You want to lock in that present rate, rather than the surely higher future rate.

At Singapore Real Estate Insider, we want to see all of our clients succeed. That's why we go through a rigorous process with each one of them, from establishing their purposes and goals in investing, to financial planning to doing the math and backwork to sell at the right price and at the right time.

For all of your property investment concerns, you are welcome to contact me so we can plan this out together to reach your goals.

Click here for a complimentary 20-min consult with us.